Latest Post and Updates

Filing income tax returns is an essential obligation for every taxpayer in India. It allows individuals to report their earnings and claim refunds if they have paid more tax than necessary during the financial year. To facilitate a seamless tax refund process, the Income Tax Department of India has introduced…

In the corporate world, the Companies Act, 2013 (hereinafter referred to as “Act”), plays a crucial role in regulating and governing the functioning of companies in India. One of the critical aspects addressed by this legislation is the provision of loans to directors. The Act has established stringent guidelines and…

Income tax is an essential source of revenue for the Indian government, contributing significantly to the nation's development and welfare. To ensure the proper collection of taxes and adherence to tax regulations, the Income Tax Department issues notices to taxpayers when discrepancies or irregularities are identified in their tax returns…

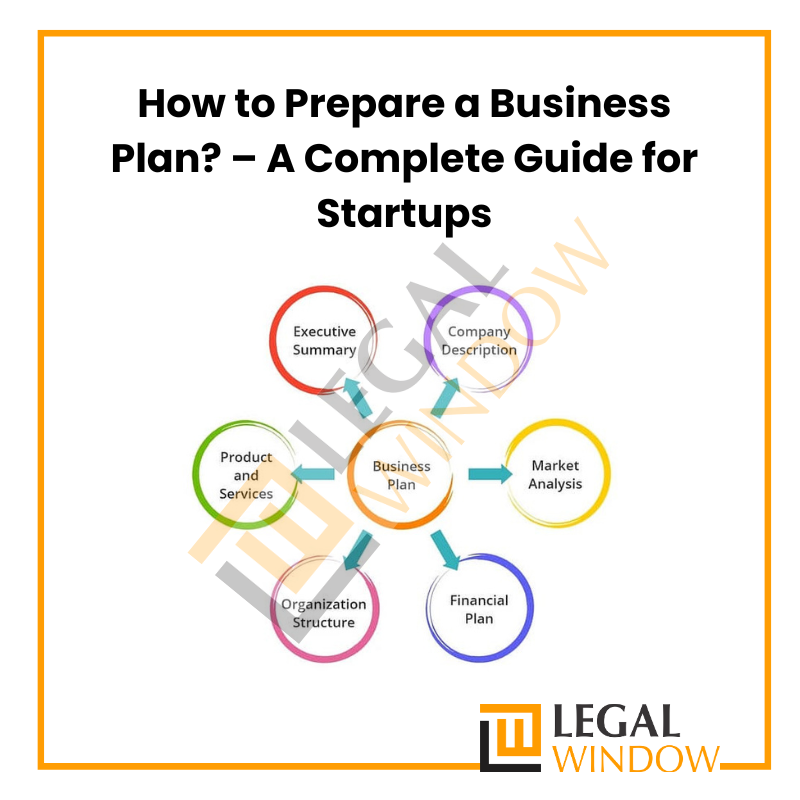

Are you excited about turning your passion into a profitable venture? Well, you've come to the right place! This easy-to-follow guide will show you how to prepare a business plan, the roadmap that will lead your startup to success. In simple language, we'll walk you through each step, ensuring you…

Have you ever wondered how certain rules and regulations under the Companies Act of 2013, apply differently to various companies? The answer lies in "Threshold Limit under Companies Act." These limits are specific monetary or operational values set by the government to classify companies based on their size, turnover, or other…

Tax planning is an essential aspect of financial management, and in a country like India, where taxes play a significant role in an individual's financial life, it becomes crucial to explore the best tax-saving schemes available. The Indian government offers several investment options that not only help taxpayers save on…

Do you want to avoid the limitations of your LLP business structure? Do you want to experience the freedom and flexibility of a Private Limited Company? Well, you're in for a treat! We invite you to embark on a transformation journey, converting your LLP into a Private Limited Company. This…

The Drug License Process in India is easy but time-consuming. The Drug License Process must be followed to launch a pharmaceutical firm. The drug license process is the first stage in obtaining permission from the relevant state authority to start a pharmaceutical business and carry out pharmaceutical-related operations. No one…

If you want to save on your taxes, you're in luck. In India, various investment plans are available to help you attain your financial goals while saving on taxes. These plans range from equity-based investments to debt-based investments, and they're designed to suit a wide range of risk profiles. You…

Are you a new member of the Employee Provident Fund (EPF) in India and wondering how to activate UAN? The EPF ensures a steady retirement savings plan for employees and employers alike. To make the management of your EPF account seamless and hassle-free, the Universal Account Number (UAN) was introduced.…

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)