Are you searching for a way to supercharge your retirement fund? Look no further than the Employees Provident Fund Deposits (EPF)! Not only does it offer the convenience of automatic contributions, but it's also one of the only investment options in India that guarantees a high rate of return. With an impressive track record of consistently high-interest rates, the EPF program has become the go-to option for savvy savers looking to ensure their financial security in retirement and EPF interest credit status. So, whether you're just starting or looking to diversify your retirement portfolio, the EPF program should be on your radar.

Applicability of Employees Provident Fund Deposits

The Employees Provident Fund (EPF) is a retirement benefits system established by the Employees Provident Fund and Miscellaneous Provisions Act, 1952. The scheme is only available to people who are employed. According to the EPF program, the employer deducts a set amount from the employee's income and puts it in their EPF account. Employers also make contributions to their employees' EPF accounts.

When the employee retires, they receive a lump sum corpus of EPF, which includes the employee's contribution, the employer's contribution, and the interest amount credited each year. The government routinely examines the interest rate on EPF accounts. The announced interest rate for the fiscal year 2022-23 is 8.15%.

EPF Interest Rate of 2023

The EPF Interest Rate for 2022-23 is set at 8.15%. This PF rate is valid for all deposits made between April 1, 2022, and March 31, 2023.

Also, read our Article on: Difference Between EPF, GPF, And PPF: Registration Process For EPF

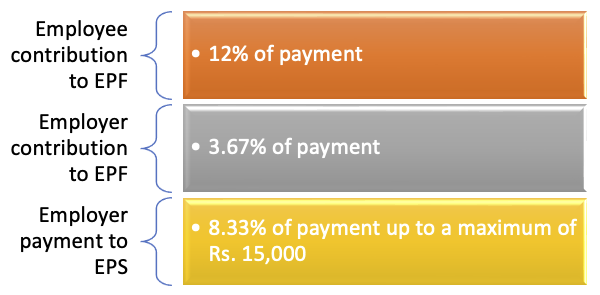

Contribution Rate for Employee Salary Up to Rs.15,000

- Employee contribution to EPF: 12% of payment.

- Employer contribution to EPF: 3.67% of payment.

- Employer payment to EPS: 8.33% of payment up to a maximum of Rs. 15,000.

i.e., Rs. 1,250.

Contribution Breakdown if Salary Exceeds Rs. 15,000

If an employee's salary is Rs.15,000 or higher, the employer's 12% payment is split in half.

8.33% of Rs 15,000 is allocated to the EPS account. i.e., Rs 1,250 each month, and the remaining sum;

Amounts over Rs 1,250 are deposited to the EPF account each month.

For instance, supposing an employee's base wage plus dearness allowance is Rs.50,000:

- Employee contribution to EPF: Rs. 6,000 (12% of Rs.50,000).

- Employer contribution to EPF: Rs. 1,835 (3.67% of Rs.50,000).

- The employer contributes Rs. 1,250 to EPS.

Because 8.33% of Rs.50,000 equals Rs.4,165, Rs.1,250 is transferred to the EPS account, while the remaining Rs.2,915 is deposited to the EPF account.

The PF account has a total balance of Rs. 10,750.

(i.e., employee contribution of Rs.6,000 + employer contribution of Rs.1,835 + employer surplus contribution to EPS of Rs.2,915.)

Also, read our Article on: Every Information on How to apply for EPF Registration in Rajasthan

Details Required for EPF Interest Rate Calculation

To calculate the EPF interest rate, the following information is required:

- An employee's present age.

- EPF balance as of today.

- A monthly basic and dearness allowance of up to Rs.15,000.

- Contribution percentage to the EPF.

- The Retirement Age.

Every month, the EPF contribution is credited to the EPF account, and interest is calculated. However, the total stake will be credited at the end of the fiscal year. The interest rate for the fiscal year 2022-23 is 8.15%. As a result, for each month's interest computation, the interest rate will be 0.679%, or 8.15%/12.

Calculation of EPF Interest

Total EPF contribution in the preceding scenario for the first month of service = Rs. 10,750.

Rate of Interest: 8.15% x 12 months = 0.679%.

- For the first month, there is no interest in the EPF contribution.

- The balance in your EPF account after the first month is Rs. 10,750.

- The second month's EPF contribution is Rs. 10,750.

- The total money accumulated in the second month of service equals Rs. 21,500.

- Interest on the second month's EPF contribution = Rs. 21,500 * 0.679% = Rs.145.985.

- At the end of the second month, the total EPF contribution balance is Rs. 21,500.

- EPF contribution for the third month = Rs. 10,750.

- The total sum accumulated in the third month is Rs. 32,250.

- Interest on the second month's EPF contribution = Rs. 32,250 * 0.679% = Rs.218.997.

- At the end of the third month, the total EPF contribution balance is Rs. 32,250.

A similar calculation is performed for the remaining months of the year. At the end of the year, the total EPF balance will be the sum of the employer contribution, employee contribution, and monthly interest accrued during the year.

In addition, the EPF account's closing balance in the first year will be the opening balance in the second year. In addition, the EPF interest for the second year will be calculated, considering the initial balance carried forward from the prior year.

Go to the EPF calculator to calculate your EPF fund after retirement.

Note:

- Income is the sum of the basic income and the dearness allowance.

- If the entity is designated or has fewer than 20 employees, a 10% wage contribution is required.

Also, read our Article on: Difference between EPF, PPF & NPS and Tax Benefits

Employer contribution to EPF if employee's salary exceeds Rs 15,000

If an employee's salary exceeds Rs 15,000, the company may choose one of the following methods:

- The employer can limit his payment to 12% of the employee's base wage plus dearness allowance, or he might contribute more.

- If the employee's pay exceeds Rs. 15,000, he may equal the employee's contribution.

Advantages of Employees' Provident Fund Deposits

The Employees' Provident Fund (EPF) is India's popular retirement savings program. One of the critical advantages of EPF deposits is the high-interest rate on employee contributions. The interest rates on EPF deposits have consistently been higher than most comparable investment options, making it a desirable choice for individuals looking to save for retirement. By contributing to the EPF program, individuals can earn a steady return on their investments while avoiding the risks associated with other investment options. It offers individuals a reliable way to save for retirement while providing financial security.

Interest Rates on EPFs for the Last 15 Years

| Financial Year | EPF Interest Rate |

| 2022-2023 | 8.15% |

| 2021-2022 | 8.10% |

| 2020-2021 | 8.50% |

| 2019-2020 | 8.50% |

| 2018-2019 | 8.65% |

| 2017-2018 | 8.55% |

| 2016-2017 | 8.65% |

| 2015-2016 | 8.80% |

| 2013-2015 | 8.75% |

| 2012-2013 | 8.50% |

| 2011-2012 | 8.25% |

| 2010-2011 | 9.50% |

| 2005-2006 to 2009-2010 | 8.50% |

Wind Up Note

The Employees' Provident Fund (EPF) is India's popular retirement savings program. The interest rates offered on EPF deposits have been consistently high, making it an attractive option for individuals looking to save for retirement. It's essential for individuals to be aware of the current interest rate and to make informed decisions about contributing to this program. While the EPF program has many benefits, individuals need to understand the program's limitations and make informed decisions about how to save for their retirement. By taking the time to understand the EPF program and making informed decisions about retirement savings, individuals can ensure that they are well-positioned for a financially secure future.

In case of any query regarding the of the interest rate of Employees Provident Fund Deposits, free to connect with our legal experts at Legal Window at 72407-51000.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.