The business requires stable working capital to operate successfully. A company can expand and improve its operations, increase liquidity, and adapt to challenging economic situations with the flexibility that sustainable working capital provides. Working capital management seeks to ensure that a business can carry on with its operations while also covering both impending operational expenses and maturing short-term debt. Keeping track of inventories, Accounts Receivable, Accounts Payable, and Cash are all parts of maintaining a working capital. Accounts Receivable (AR) are a result of the practice of conducting business on credit terms and appear in the financial accounts. In order to provide a steady flow of operating capital into the firms, this credit facility has been established. In this article we will try to answer the question “What is Accounts Receivable?”

What is Accounts Receivable?

- Accounts receivable (AR) is the amount owed by customers who have made credit purchases of goods and services to the business. The credit period is typically brief, lasting only a few days, a few months, or perhaps even a year.

- A company accepts cash and credit for the sale of its products and services. When a company gives a customer credit, the sale is considered to have occurred when the invoice is created, but typically, the consumer is given a deadline for making the required payment. Accounts receivable (AR) is a term used in the financial statements to describe the process of conducting business on credit terms.

- On the balance sheet, account receivables (AR) are categorized as current assets. The line of credit that the customer has with the business affects the amount of accounts receivable.

Accounts receivable, for instance, serves as a record of the fact that a company has completed work for a client X and that customer X owes the company money. The credit period is often brief, lasting anywhere from a month or two to a year.

The Significance of Accounts Receivable

- The amount of money that clients owe a company for goods and services already rendered is measured by accounts receivable services. They are seen as potential assets that can be used at any time. However, the process of turning your accounts receivable into cash should be proactively optimized if you want accounts receivable to become an asset.

- Businesses benefit from improved accounts receivable by releasing cash as soon as possible, which builds working capital over time. Since receivables are a significant portion of a company's asset, they produce cash inflow on the books of the company. Accounts receivable optimization can significantly improve the elements of the . It stops the capital from being wasted, increasing liquidity in the process.

- This finally enables companies to lower their debt, finance expansion, and aids in their ability to broaden their horizons.

- To streamline and smooth the transaction process and build a solid credit relationship between the parties concerned, companies that offer credit facilities to their consumers. It can result in better bargains or raise the possibility of enhancing working capital management.

Because it is a key source of cash flow for a company, its accounts receivable is crucial. Businesses can boost their sales and income by giving clients credit. However, proper management of accounts receivable is essential to make sure that the company receives payments on schedule and does not experience cash flow issues.

Accounts receivable Audits

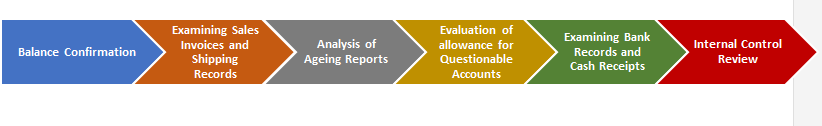

Accounts receivable auditing entails a number of steps used to confirm the accuracy and completeness of the recorded balances. The typical audit techniques used to confirm the existence, ownership, and value of accounts receivable are as follows:

- Balance confirmation: To confirm the balances of the clients' accounts receivable with the business, the auditor often sends confirmation requests to the clients. This process aids in confirming the validity and accuracy of the balances.

- Examining Sales Invoices and Shipping Records: The auditor examines sales invoices and shipping records to make sure that the sales transactions are accurately recorded and that the customers have received the goods or services.

- Analysis of Ageing Reports: The auditor examines the accounts receivable ageing reports to evaluate the accuracy of the accounts and identify any past-due or disputed accounts. This process aids in assessing the accounts' accuracy and completeness.

- Evaluation of allowance for Questionable Accounts: The auditor examines historical bad debts, client creditworthiness, and economic conditions to determine whether the allowance for doubtful accounts is adequate. This process aids in ensuring the accuracy of the Accounts receivable

- Examining Bank Records and Cash Receipts: The auditor looks at bank records and cash receipts to ensure that money received from clients is reported correctly in the accounts receivable.

- Internal Control Review: The auditor examines the company's internal controls over accounts receivable, including credit policies, authorization processes, and responsibility segregation. This process aids in making sure that the balances of the account receivable are legitimately authorized and recorded.

The auditor can guarantee that the accounts receivable is accurate and complete by carrying out these audit procedures and obtaining sufficient and pertinent evidence. As a result, the auditor can take the necessary action to resolve any serious misstatements or fraud in the accounting.

Accounts receivable Impairment Assessment

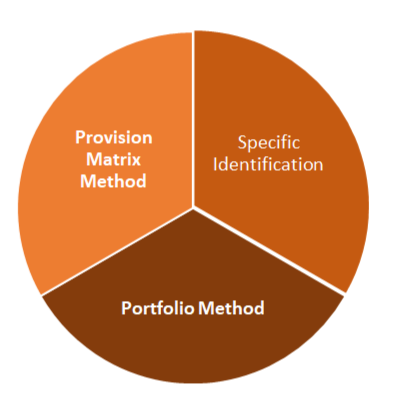

A decline in an asset's value, including accounts receivable, as a result of a scenario or event that suggests that the asset's carrying amount would not be collected is referred to as impairment. In other words, when an asset's recoverable amount is lower than it carrying amount, it is said to be impaired. The following techniques are used to determine whether an account is impaired:

- Specific Identification: To establish if an account receivable is affected, this method requires identifying and evaluating each individual account separately.

- Portfolio Method: The portfolio methodology groups receivables with comparable risk characteristics and evaluates them as a portfolio for impairment.

- Provision Matrix Method:The provision matrix methodology uses probability analysis and historical data to calculate the amount of impairment based on the ageing of accounts receivable.

Indian Accounting Standards (Ind AS) and the Companies Act, 2013, both offer instructions on how to assess whether an account is impaired. At the conclusion of each reporting period, accounts receivable shall be evaluated for impairment in accordance with Ind AS 109, Financial Instruments. According to the standard, an impairment loss must be recorded if there is objective proof of an impairment, and the amount of the loss must be calculated as the difference between the carrying value and the amount that can be recovered.

According to the Companies Act, 2013, each f account, particularly those pertaining to accounts receivable, and make sure that the records are audited by a licensed auditor. Reports on the accuracy of the accounting records and conformity with the accounting rules are due from the auditor.

In a nutshell determining whether the carrying amount can be recovered using a variety of techniques and indicators is the goal of the impairment evaluation of accounts receivable. To make sure that the impairment assessment is carried out in line with the accounting standards and the legal obligations, guidance is provided by the Ind AS and the Companies Act, 2013.

How are Accounts receivable accounted for in the financial statements?

The assets in a company's financial statement are typically increased because businesses anticipate receiving money in the future. To prevent any default in the payment due, accurate record keeping of this money that is owed (accounts receivable) in the books of accounts is necessary.

The following are a few tips regarding the recording of accounts receivable:

- Establishing Credit Transactions as a Practice

The company may start the practice of giving its customers a credit policy. This credit can be extended for a set amount of time, and any missed payments typically result in penalties. The terms and conditions for such credit transactions must be agreed upon by the parties involved in this credit facility practice.

Before accepting any terms and conditions, the facility provider should also confirm the customer's ability to pay.to avoid a loss of incoming cash.

- Producing invoices for the Client

Businesses must produce invoices for any sales made or services rendered. The cost of the goods and services sold to the clients should be disclosed in the invoice. This invoice generation process makes sure that the credit transaction is accurately recorded in the company's accounts. The customer is also provided a copy of the invoice so they can pay according to the terms agreed upon.

- Keeping track of the payments made and those still outstanding

To keep track of customer payments that have been made or that are still owed, an accountant is needed. The customer's ledger account must be updated with the payment method information and receipt date. This guarantees that the credit amount is correctly accounted for. Additionally, the companies must send out prompt notifications to customers for any unpaid balances.

- Accountability for the Accounts Receivable

All due dates for payments to be received must be noted by the accountant or person in charge of handling accounts receivables properly. Receiving payments from clients on time is a result of the accounts receivable being recorded promptly and in good time. The account for the specified party can be settled permanently once the account receivable is entered and payment is made.

What is management of Accounts Receivable?

The practice of making sure that customers pay their debts on time is known as accounts receivables management. It aids companies in preventing themselves from ever running out of working capital. Additionally, it avoids clients' outstanding balances from going unpaid or being paid past due. It strengthens the financial and liquidity position of the company.

By lowering the chance of any bad debts, effective receivable management increases profitability. Reminding clients to pay their bills and timely money collection are just two aspects of management. It also entails figuring out the causes of these delays and resolving the problems.

Process for the Accounts receivable Management

The following are components of an Accounts receivables management process:

- Credit Rating: Before accepting any terms and conditions, the credit rating, or the customers' ability to pay, will be examined.

- Continuous Tracking: Monitoring the opportunity for non-payment or delay in getting funds constantly.

- Good Customer Relations: Maintaining good customer relations will help you cut down on bad debts.

- Addressing Complaints: Responding to customer complaints.

- Reduced Amount: The amounts in the specific account receivable should be decreased after receiving the payments.

- Prevention of Bad Debts: Preventing any bad debts from the outstanding receivables for a specific time.

Tips for Effective Accounts Receivable Management

The following are some guidelines you can use to efficiently manage the accounts receivables process:

- Specific Information about the Client

Accurate records should be kept of the customer to whom the business has granted credit. Their account information, address, and everything else should be current. Customers' accounts should be routinely audited to look for odd payment conditions, credit limits, etc. Any modification to the customer's information must be properly documented. Receivables are delayed if information is not added appropriately.

- Effective billing and Invoicing Procedures

Customer billing and invoicing should be accurate and precise. Although invoicing appears to be a very simple and uncomplicated process, numerous companies frequently experience difficulties. Units of measure, price, and inaccurate client information are some of the common mistakes made in invoices. Many people don't produce bills on time. An efficient billing/invoicing procedure needs to be designed to address these problems.

- Management of Credit

The credit line shouldn't be increased purely for the purpose of boosting sales. One of the possible issues that can develop in the absence of effective credit management is that this tactic frequently fails over time.

- Track the Accounts receivables

The accounting officer is in charge of making sure that the money is deposited on time once the invoicing is finished. Additionally, the officer sends monthly statements to its customers that detail the amount outstanding.

- Active Collection

Any business owner should priorities collecting money in order to keep the company's cash flow positive. Businesses should use a thorough accounting procedure to improve the collecting process. In addition, it should be guaranteed that the reductions are applied effectively and in a way that benefits the business.

- Concept of Automation

The way business is conducted today has changed as a result of automation. It has streamlined processes and increased efficiency. Even while good software can be expensive up front, once everything is set up, the end results are very favorable. In many respects, automation makes the accounts receivables process simpler, such as by reminding clients when their payments are due. Additionally, automation lessens the demand for labor while simultaneously enhancing the speed and security of payments.

Pitfalls in Accounts Receivable

The following are the pitfalls in Account Receivables:

- Accounts receivables are frequently neglected by business owners, which ultimately has a negative impact on their operations. Businesses frequently place a higher priority on sales, and in order to enhance those sales, they frequently give discounts while ignoring payment requirements. And soon, these companies start offering free finance to their clients.

- The account receivable process is also impacted by extending credit to unsuitable clients and then failing to keep track of it. Poor receivables management has a ripple impact that essentially touches every part of running a business.

- Businesses may eventually run into major problems if they don't properly keep track of all the deadlines for payments to be received and don't pay close attention to the accuracy of bills and invoices.

Way Forward

Businesses frequently place a higher priority on sales than they do on accounts receivable. However, bad AR procedures result in a number of issues for companies. Poor AR procedures eventually drain businesses of time, money, and productivity. Accounts receivables are crucial to maintaining the working capital of the company, so it is crucial for any business owner to pay attention to them.

Connect to the Experts at Legal Window in case you need any assistance in understanding the concept of Account Receivables. Our Experts would be Happy to Help.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.