Due Diligence Process: Unveiling the Pillars of Informed Decision-Making

- August 8, 2023

- Compliance

In the world of business and finance, the term "due diligence" holds significant importance. It refers to the meticulous process of conducting research, analysis, and investigation before making important decisions, particularly in the context of Mergers and Acquisitions (M&A), investments, legal agreements, and other significant transactions. Due diligence serves as a vital tool for mitigating risks, ensuring compliance, and making informed decisions that can have lasting impacts on businesses and individuals alike. In this article we will discuss about Due Diligence, its importance, and Due Diligence Process in Brief.

Understanding Due Diligence

Due diligence is a comprehensive and systematic examination of all relevant information and factors that could influence a particular decision or transaction. The purpose of this process is to assess the accuracy, completeness, and validity of data and ensure that no crucial details are overlooked. Through due diligence, individuals and organizations can make well-informed and rational choices based on a thorough understanding of the risks and potential benefits involved.

It is a critical step as it enables the buyer to obtain a clear picture of the target's current state, potential liabilities, and growth prospects. Conversely, sellers can benefit from conducting due diligence to rectify issues proactively, thus increasing the company's attractiveness to potential buyers.

Objectives of Due Diligence

The following are the objectives of Due Diligence:

- Risk Identification and Mitigation: One of the primary objectives of due diligence is to identify potential risks and vulnerabilities that may affect the success of a transaction or deal. By thoroughly scrutinizing financial records, legal documents, and operational processes, stakeholders can assess the likelihood of encountering financial, legal, or reputational risks. Armed with this knowledge, they can take appropriate measures to mitigate or manage these risks effectively.

- Verification of Information: Due diligence aims to verify the accuracy and authenticity of information provided by the target company or individual. In an era where information can be easily manipulated or misrepresented, conducting due diligence ensures that decision-makers base their judgments on reliable and factual data.

- Evaluation of Financial Health: Financial due diligence is a crucial aspect of the process, especially in M&A. It involves a comprehensive analysis of financial statements, cash flow, debt, and assets, providing a clear picture of the target's financial health. Understanding the financial position of the entity helps potential investors or buyers make informed decisions and determine a fair valuation.

Also read our Article on: What are the Basic Financial Statements?

- Compliance and Legal Scrutiny: Ensuring compliance with applicable laws, regulations, and industry standards is vital for any business. Due diligence investigates the target company's compliance status, including licenses, permits, and any ongoing legal matters. This process helps buyers avoid potential legal liabilities and safeguard their reputation.

- Assessment of Business Strategies: For strategic partnerships or investments, understanding the target company's business model and strategies is crucial. Due diligence evaluates the effectiveness of existing strategies and potential growth opportunities. This analysis assists stakeholders in determining whether the business aligns with their own objectives and if the partnership will be mutually beneficial.

- Evaluation of Intellectual Property: In cases where Intellectual Property (IP) is a significant asset, company due diligence assesses the ownership, validity, and potential infringement risks associated with the target's IP portfolio. This step helps safeguard against future legal disputes and ensures the sustainability of the business's competitive advantage.

Scope of Due Diligence

The scope of Due Diligences is as follows:

- Legal Due Diligence: Legal due diligence involves the examination of legal documents, contracts, licenses, permits, and other legal agreements to identify any potential legal risks or liabilities. It ensures that the target entity has clear ownership of assets, there are no pending litigations that could affect the transaction, and the entity complies with relevant laws and regulations.

- Financial Due Diligence: Financial due diligence focuses on analyzing the target's financial statements, tax records, cash flow, and overall financial health. This pillar aims to assess the accuracy of financial information provided, identify potential financial risks, and evaluate the target's ability to generate profits and sustain growth.

- Commercial Due Diligence: Commercial due diligence aims to understand the target's market position, competitive landscape, customer base, and growth prospects. It helps investors or acquirers evaluate the target's potential for future success and whether the business model aligns with their strategic goals.

- Operational Due Diligence: Operational due diligence examines the target's internal processes, systems, and operational efficiency. This pillar assesses whether the target can effectively manage its operations, deliver products or services efficiently, and achieve its projected goals.

- Environmental Due Diligence: Environmental due diligence evaluates the target's environmental practices, compliance with environmental regulations, and potential environmental liabilities. It ensures that the target's operations are sustainable and do not carry significant environmental risks that could impact its reputation or future operations.

- Human Resources Due Diligence: Human resources due diligence focuses on the target's workforce, including its organizational structure, key personnel, employee contracts, and potential labor-related risks. Understanding the target's talent pool is crucial to assess the continuity of critical functions and potential human capital challenges.

- Intellectual Property Due Diligence: Intellectual property due diligence involves assessing the target's intellectual property rights, such as patents, trademarks, copyrights, and trade secrets. This pillar ensures that the target owns or has proper licenses for its intellectual property, protecting its competitive advantage and avoiding potential legal disputes.

Different Types of Due Diligence

The following are the different types of Due Diligence:

- Financial Due Diligence: Financial due diligence is one of the most common and critical types of due diligence, particularly in Mergers and Acquisitions (M&A), investments, and partnerships. This process involves a thorough examination of the financial records, statements, and accounting practices of a company or business. Financial due diligence aims to identify any discrepancies, hidden liabilities, or financial risks that might impact the overall value of a deal. It also helps potential investors or buyers assess the financial health and future prospects of the target company.

- Legal Due Diligence: Legal due diligence involves an exhaustive assessment of the legal aspects of a business or transaction. This process is crucial in mitigating potential legal risks and liabilities. Legal experts scrutinize contracts, agreements, permits, licenses, litigation history, intellectual property rights, and compliance with relevant laws and regulations. By uncovering any legal issues, both parties can negotiate and implement necessary safeguards or reevaluate the transaction's feasibility.

- Operational Due Diligence: Operational due diligence focuses on assessing the operational aspects of a business or organization. It aims to identify potential inefficiencies, operational risks, and areas for improvement. This type of due diligence is particularly valuable in private equity investments, where understanding the target company's operational capabilities is crucial for optimizing performance and maximizing returns.

- Environmental Due Diligence: In the context of real estate transactions and industrial projects, environmental due diligence is essential. This process involves evaluating potential environmental risks and liabilities associated with a property or project. Environmental experts conduct site assessments to identify any contamination issues, adherence to environmental regulations, and compliance with environmental permits. Addressing environmental concerns can prevent costly liabilities and reputation damage.

- Human Resources Due Diligence: Human resources due diligence is relevant in mergers, acquisitions, and business partnerships. This process evaluates the workforce's capabilities, compensation packages, benefits, labor disputes, and overall organizational culture. Understanding the human resources aspect helps in anticipating any potential HR-related challenges and devising strategies for a smooth integration or partnership.

- Informational Technology Due Diligence: Informational Technology due diligence examines the information technology infrastructure and systems of a company. It evaluates the security measures, data protection protocols, software licenses, and potential Informational Technology risks. In today's digital age, Informational Technology due diligence is essential to safeguard sensitive information and ensure that technology assets align with the organization's goals.

- Company Due Diligence: Company due diligence is commonly performed when evaluating market opportunities, new business ventures, or product launches. This type of due diligence assesses market dynamics, customer behavior, competitive landscape, and industry trends. By examining market potential and demand, company due diligence helps organizations validate their business strategies and make well-informed decisions about market entry or expansion.

Instances When Due Diligence is required?

The following are the instances where Due Diligence is required:

- Mergers and Acquisitions: During mergers and acquisitions, both parties must conduct due diligence to assess each other's financial health, legal standing, market position, intellectual property rights, and potential synergies.

- Investment Decisions: Prior to investing in a company or project, investors perform due diligence to evaluate the opportunity's viability and risks.

- Partnerships and Joint Ventures: When entering into partnerships or joint ventures, due diligence is essential to understand the strengths and weaknesses of each party, align goals, and assess potential risks.

- Real Estate Transactions: Before purchasing real estate, buyers conduct due diligence to verify property ownership, legal issues, zoning regulations, and potential environmental concerns.

- Employment Practices: Employers may perform due diligence before hiring new employees, especially for critical positions, to ensure candidates' qualifications and avoid potential legal issues.

- Regulatory Compliance: Companies often conduct due diligence to ensure compliance with various regulations and avoid potential penalties or reputational damage.

Benefits of Due Diligence: Ensuring Informed Decisions and Mitigating Risks

The following are the benefits of Due Diligence:

- Informed Decision Making: The primary benefit of due diligence is that it provides stakeholders with a comprehensive understanding of the subject matter. Whether it's a company, an investment opportunity, or a potential partner, conducting thorough research allows decision-makers to gather relevant data, facts, and insights. Armed with this information, they can make informed choices, avoiding hasty decisions that could lead to negative consequences.

- Risk Mitigation: In business, risk is inevitable, but it can be managed effectively through due diligence. When engaging in a new venture or considering a partnership, understanding potential risks is crucial. By conducting due diligence, one can identify potential red flags, financial vulnerabilities, legal issues, or operational inefficiencies that could jeopardize the success of the venture. This knowledge empowers decision-makers to either renegotiate terms or even decide against proceeding with the deal.

- Financial Security: For investors, due diligence is a vital tool for ensuring financial security. Analyzing the financial health and performance of a company or investment opportunity helps investors assess whether the venture aligns with their risk appetite and financial goals. It enables them to make confident investment decisions while avoiding potential pitfalls that could lead to financial losses.

- Legal and Regulatory Compliance: In an increasingly complex legal and regulatory environment, compliance is paramount. Businesses must ensure that they are operating within the boundaries of the law and adhering to industry-specific regulations. Through due diligence, companies can assess their compliance status and identify any areas that need improvement. This proactive approach not only prevents legal issues but also fosters a reputation of integrity and trustworthiness.

- Negotiation Leverage: In negotiations, knowledge is power. Conducting due diligence provides valuable insights that can be used as leverage during the negotiation process. Armed with a thorough understanding of the subject matter, parties can negotiate better terms, pricing, or conditions. This can lead to more favorable deals that align with their interests and objectives.

- Strengthening Reputation and Relationships: By conducting due diligence, companies demonstrate their commitment to transparency and ethical business practices. This reinforces their reputation and fosters trust with stakeholders, including clients, partners, investors, and regulatory authorities. Trust is the cornerstone of successful long-term relationships, and due diligence helps build that trust.

- Operational Efficiency: When conducting due diligence, organizations get a comprehensive view of the operational aspects of a business or process. This insight allows them to identify potential inefficiencies and areas for improvement. By addressing these issues, companies can enhance their operational efficiency, reduce costs, and optimize resources.

- Business Valuation: For mergers and acquisitions, due diligence is critical in determining the fair value of a target company. A thorough examination of financial statements, assets, liabilities, and potential risks helps in arriving at a realistic valuation. This is crucial to avoid overpaying for an acquisition and to ensure the deal's long-term success.

Documents necessary for Due Diligence Processing

The following types of documents must be reviewed during the Due Diligence Process:

- The company's information

- Financial Information

- Important Business Agreements

- Details of Intellectual Property Rights

- Litigation Factors

- Marketing Details

- Internal Control Verification System

- Aspects of taxation

- Insurance Protection

- Environmental Considerations

- Aspects of Human Resources

- Aspects of Culture.

Know the Due Diligence Process

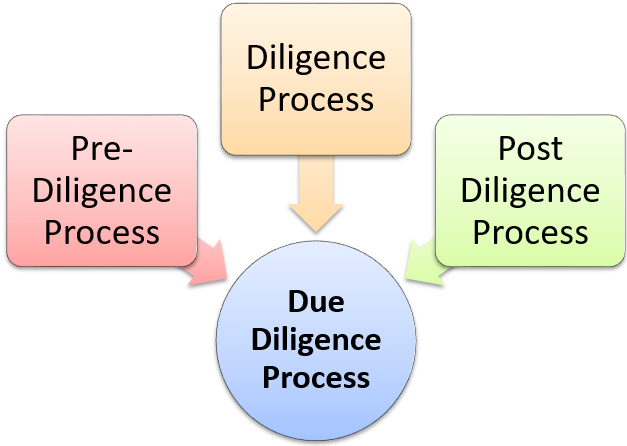

The Due Diligence Process in Company divided into three stages:

- Pre-Diligence Process

- Diligence Process

- Post Diligence

Pre-Diligence Process

The Pre-Diligence Process is the first phase in the Due Diligence Process and is largely concerned with the management of documents and people.

- First, the investor must sign the Letter of Intent and the Non-Disclosure Agreement.

- Agreement of Disclosure with the Target Company.

- Receiving the document from the company and comparing it to the checklist of documents previously supplied to the company.

- Recognizing the problems.

- Organizing the documents needed for due diligence.

- Making of a Data Room: A data room discloses confidential material that is not publicly available and may relate to corporate processes, trade secrets, technology information, and so on. It offers all relevant business documents, whether they are financial, regulatory, intellectual property, marketing, or any other important material part of a business transaction.

Data Room: The Data Room is the most common way to employ a 'virtual data' room to handle the issue of secrecy. However, we reserve the right to demand as needed. Admission to the data room is frequently limited in time and may be restricted to a small number of people at any given moment. The 'data room' will contain all information relevant to the investment purpose.

Due Diligence Process

Following the completion of the Pre Due Diligence Process, the professional submits the Due Diligence Report.

Due Diligence Report

Because the information gathered throughout this process is critical for decision making, it must be made public. Once the due diligence is completed, the professionals produce a report known as "THE DUE DILIGENCE REPORT" in spoken language.

The Due Diligence report aids in demonstrating how the organization intends to produce additional earnings (both monetary and non-monetary). It functions as a ready reckoner for explaining the condition of affairs at the time of purchase/sale, and so on. The ultimate goal is to gain a thorough grasp of how the company will function in the future.

The due diligence report are of two types-

- Summary Report.

- Detailed Report

Furthermore, the Due Diligence Report's findings might be of several types-

- Deal Breakers: The outcome of this type of analysis can be quite obvious and may disclose different non-compliances that may develop, such as any criminal proceedings or recognized liabilities.

- Deal Diluters: The outcome of a diligence may involve infractions that have an impact in the form of quantifiable penalties and, as a result, may result in a decrease in the value of the company.

- Deal Cautioner: Deal cautioners encompass those findings in due diligence that may not have an influence on the financials, but there are documented non-compliances that, while fixable, need the investor to tread carefully.

- Deal Makers: Deal Makers are difficult to find and may not be true in the literal sense. In these reports, the diligence reports team was unable to find any violations, prompting them to submit a 'Clean Report'.

- Post Due Diligence Process

Post-Diligence involves the correction of non-compliances discovered during Due-Diligence. Post due diligence is an intriguing process that results from the diligence performed by the team of professionals. Making the application, filing the petition for compounding of offences, or negotiating the shareholder's agreement are all part of the process. The post-dilution process assists the investor in negotiating the contract.

Best Practices for Conducting Due Diligence Process

While the specifics of due diligence on the company may differ depending on the context, some best practices apply universally:

- Clearly Define Objectives: Establish specific objectives and areas of focus for the Due Diligence Process. This will ensure that the investigation stays on track and covers all critical aspects.

- Assemble a Competent Team: Form a team of experts with diverse skills, including financial analysts, legal advisors, industry specialists, and operational experts. Their combined knowledge will provide a comprehensive assessment.

- Secure Necessary Documentation: Request and review all relevant documents and records from the subject company, ensuring nothing is overlooked.

- Cross-Verify Information: Cross-verify information provided by the subject company through external sources and independent research. This helps validate the accuracy of the data.

- Communicate and Document Findings: Maintain clear communication channels between the parties involved and document all findings meticulously. This ensures transparency and serves as a valuable reference in the future.

- Evaluate Potential Deal Breakers: Identify critical issues that may pose substantial risks or hinder the success of the transaction. Evaluate whether these deal breakers can be addressed or if they render the transaction unfeasible.

- Seek Professional Advice: When in doubt or dealing with complex issues, seek advice from external experts or consultants to ensure a comprehensive evaluation.

You can also seek advice of our Legal Experts at Legal Window. They assists you in simplifying all your doubts regarding Due Diligence Process.

Conclusion

Due diligence is an indispensable part of any significant business transaction or investment. By conducting a thorough investigation of the subject company's financial, legal, operational, and commercial aspects, parties can make informed decisions, mitigate risks, and seize valuable opportunities. It is a process that demands careful planning, expertise, and attention to detail but is ultimately a crucial step towards successful and sustainable business ventures.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.