The executive board makes decisions and determines actions on behalf of a company in the corporate world. But how will this function in practice? It's not quite as straightforward as the selections individuals make along the way. The goals set at this stage have such a significant impact on a significant number of people's livelihoods and income. Corporation decisions make one's way by the directors of the company to make major strategies legally binding. However, a resolution is a written document which came into existence specifically by the Board of Directors. It certifies a legally enforceable business action. In this blog we will cover Ordinary Business & Special Business under the Companies Act, 2013.

The executive board makes decisions and determines actions on behalf of a company in the corporate world. But how will this function in practice? It's not quite as straightforward as the selections individuals make along the way. The goals set at this stage have such a significant impact on a significant number of people's livelihoods and income. Corporation decisions make one's way by the directors of the company to make major strategies legally binding. However, a resolution is a written document which came into existence specifically by the Board of Directors. It certifies a legally enforceable business action. In this blog we will cover Ordinary Business & Special Business under the Companies Act, 2013.

| Table of Content |

Concept of Business

The essential idea behind a firm is the business concept. This notion is used to construct the business model, plan, vision, and mission. For example, Uber was founded on the idea of combining taxi drivers and delivering on-demand services under one brand. This principle served as the foundation for all subsequent corporate strategies.

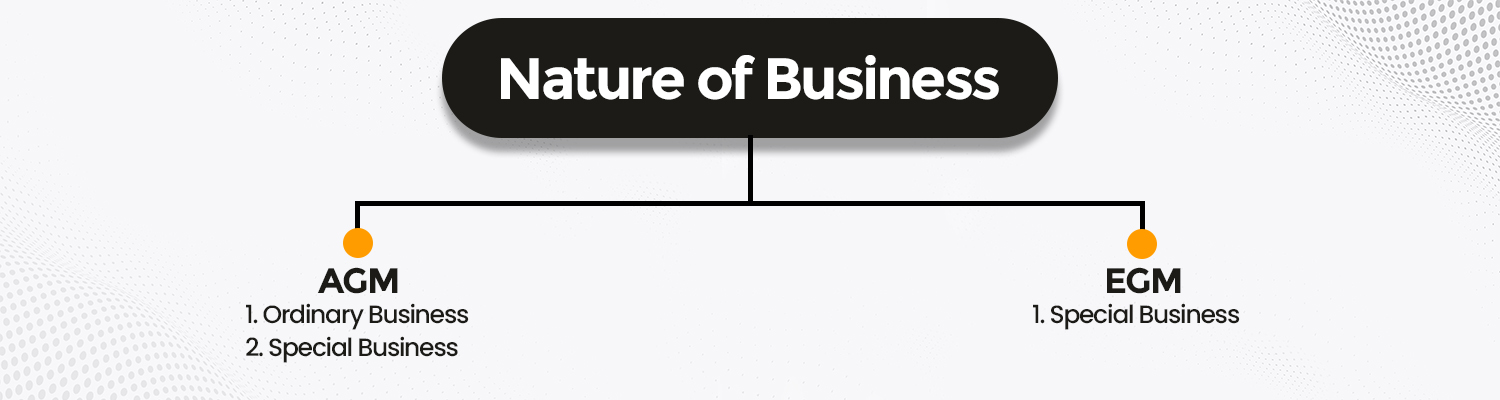

Nature of the Business

The phrase 'General Meeting' refers to shareholder meetings, including Annual General Meetings and Extra-Ordinary General Meetings, as defined by the Companies Act, 2013. Every company is supposed to convene an Annual General Meeting every fiscal year. This is a necessity that no firm is free from. A firm's Annual General Meeting is held supplementary to some other meetings. Further, the importance of the Annual General Meeting stems from the nature of the business taking place there. Ordinary business and special business are the two categories of business that are reviewed during an Annual General Meeting.

Additional bonus General Meetings take place in between Annual General Meetings to deal with any unique or essential matters that may require. Special Business refers to all activities conducted at an Extraordinary General Meeting.

Concept of Ordinary Business

It is the type of business which must be dealt at an Annual General Meeting (AGM). According to the Section 102 of the Companies Act, 2013, criteria for determining parameters, so that they can include it in ordinary business after fulfilling the certain conditions are:

- Consideration of financial Statements and the reports by the Board of directors;

- Declaration of dividend;

- Appointment of directors to replace those who are retiring;

- Recruitment of the auditors of fixing of their remunerations;

As a result, if the forgoing parameters are fulfilled as per norms of Annual Meeting, then it takes the form of ordinary business.

Concept of Special Business

The types of businesses other than the ordinary business are special business.

Directors can discuss special business in an Annual General Meeting or a special meeting by assembling special needs i.e. extraordinary meetings to discuss the issues occurring at an urgent basis.

Explanatory Statement

The Goal of the explanatory statement is to provide significant information that will assist a member in comprehending the meaning, scope, and impact of the business item and making an informed choice before to voting on the resolution.

An explanatory statement must be added to the notice of the meeting for any business other than ordinary business, i.e., Special Business to be done in Annual General Meeting and all business to be transacted at Extra-Ordinary General Meeting.

Difference between Ordinary Business and Special Business

The following are the difference between the ordinary business and special business:

- It is not essential to mention resolutions in any Ordinary Business whereas in the case of the Special Business the agenda for holding a meeting must be

- Ordinary Business shall not carry out under the postal ballot where as in the case of the Special Business it may be considered by means of postal

Concept of Resolution

A resolution is an agreement made by the company's members at a meeting. It is a written document that contains crucial decisions. Ordinary and Special resolutions are discussed in the Companies Act, 2013, respectively. The resolutions are governed by the company's MOA and AOA. It can be performed during both general and board meetings.

There are two types of resolutions i.e. Ordinary Resolutions and Special Resolutions.

- According to Section 114(1), Ordinary resolutions make one's way in Ordinary Notice for such meetings shall be given out before and almost 51% of the votes are vital to pass a resolution.

- According to Section 114(2), Special Resolutions may proceed with special However, in which 75% of the members voted in favor of the resolution.

- Amendment articles of association required special resolutions i.e. Reduction of share capital, buyback of shares, loan and investment, recruitment of more than 15 directors

Endnote

Endnote

Businesses are classified into two categories according to their need of consideration by the Board of directors as per the Companies Act, 2013. However, this leads to efficient working and decision making. This will aid in the progress of a particular company.

Get your business registered through our experts.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.