Shop and Establishment License in Sikar: A Guide to Compliance and Growth

- July 26, 2023

- Startup/ Registration

Getting Shop and Establishment License in Sikar, a vibrant city in the Indian state of Rajasthan, requires compliance with various legal and regulatory requirements. One such crucial requirement is obtaining a Shop and Establishment License. This license is a legal document issued by the local municipal corporation or municipality that permits an individual or entity to operate a commercial establishment within a specific jurisdiction. In this article, we will delve into the details of acquiring a Shop and Establishment License in Sikar.

Getting Shop and Establishment License in Sikar, a vibrant city in the Indian state of Rajasthan, requires compliance with various legal and regulatory requirements. One such crucial requirement is obtaining a Shop and Establishment License. This license is a legal document issued by the local municipal corporation or municipality that permits an individual or entity to operate a commercial establishment within a specific jurisdiction. In this article, we will delve into the details of acquiring a Shop and Establishment License in Sikar.

Before we move on to discuss about the procedure for getting shop act licence, let us first move on to discuss about Shop and Establishment License in great detail.

Quick Look

In every bustling city or town, you will find numerous shops, offices, and commercial establishments operating to cater to the needs of the community. Behind the scenes, there are legal frameworks in place to regulate and govern the functioning of these establishments. One such essential legal framework is the Shop and Establishment Act, 1948 (hereinafter referred as Shop and Establishment Act) which plays a crucial role in ensuring fair practices and the welfare of workers.

The Shop and Establishment Act, also known as the Shops and Establishments Act, is a state-level legislation that governs the working conditions, hours of operation, and employment terms of establishments. This act applies to various commercial establishments, including shops, offices, restaurants, hotels, amusement parks, theatres, and other similar establishments. Its primary objective is to provide a safe and healthy work environment for employees and protect their rights.

The provisions under the Shop and Establishment Act vary from state to state within a country. Shop and Establishment License in Sikar, like each state has its own set of rules and regulations, although they generally cover common aspects such as working hours, leave policies, wages, holidays, and employment conditions. It is crucial for employers and employees to be aware of these laws to ensure compliance and avoid legal complications before getting shop establishment certificate.

Meaning of Shop and Establishment License

In India, every business establishment, whether it is a shop, office, restaurant, or any other commercial establishment, is required to obtain a Shop and Establishment License under the respective state’s Shops and Establishments Act. This license is a legal requirement that regulates the working conditions, employment rights, and other aspects of businesses.

The Shop and Establishment License is governed by the state-level legislation and varies slightly from one state to another. However, the basic objective remains the same – to provide a legal framework for the operation of commercial establishments while safeguarding the interests of employees and ensuring the welfare of workers.

The license is issued by the Department of Labour or the Municipal Corporation, depending on the state, and is mandatory for all types of commercial establishments. It is a document that certifies that the business is complying with all the rules and regulations related to working hours, holidays, wages, and other labour-related provisions.

Obtaining a Shop and Establishment License in Sikar is a crucial step for any business operating in Sikar. By ensuring compliance with labour and commercial laws, this license protects the rights of employees and establishes your business as a credible and trustworthy entity.

Key features of the Shop and Establishment License

Here are some key features of the Shop and Establishment License:

- Registration: Every business entity, including shops, commercial establishments, residential hotels, restaurants, and theatres, must register and obtain a shop act licence within a specific period from the date of commencing operations.

- Working Hours: The license specifies the permitted working hours for the establishment. It defines the opening and closing time, daily working hours, and rest intervals for employees. These provisions vary across states but usually restrict working hours to 9 to 10 hours per day.

- Weekly Holidays: The Shop and Establishment License ensures that employees get at least one day off every week. Generally, this day is Sunday, but it can differ depending on the nature of the business and state regulations.

- Overtime and Wages: The license ensures that employees are paid overtime wages if they work beyond the specified working hours. It also mandates the payment of minimum wages as per the Minimum Wages Act, 1948 enacted by the central or state governments.

- Leave and Benefits: The license outlines the provisions for various leaves, such as casual leave, sick leave, and annual leave, along with maternity leave for female employees. It also covers other benefits like provident fund, gratuity, and medical facilities.

- Safety and Working Conditions: The license emphasizes the maintenance of proper hygiene, cleanliness, ventilation, and lighting in the workplace. It also lays down guidelines for fire safety, first aid, and other necessary facilities.

- Employment of Women: The license includes provisions for ensuring the safety and welfare of female employees. It restricts night shifts for women and mandates suitable working conditions for them.

- Record-Keeping: Establishments are required to maintain specific records, including attendance registers, wage registers, and leave records, as prescribed by the respective state’s rules.

Importance of Shop and Establishment License

The Shop and Establishment License holds immense importance for both business owners and the local government. Here are some key reasons why this license is crucial for businesses operating in Sikar:

- Legal Compliance: The license ensures that businesses comply with the regulations set forth by the local government. It serves as proof that the establishment is registered and operates within the framework of applicable laws.

- Business Credibility: Having a valid license enhances the credibility and reputation of a business. It instils confidence in customers, suppliers, and stakeholders, as it assures them that the business operates legitimately.

- Employee Welfare: The Shop and Establishment License includes provisions related to working hours, overtime, leave policies, and other labour welfare measures. Obtaining this license ensures that businesses maintain proper working conditions for their employees.

- Statutory Benefits: The license is a prerequisite for availing various statutory benefits such as provident fund, gratuity, and employee insurance schemes. It enables employers to fulfil their obligations towards their workforce.

Eligibility for Shop and Establishment Registration

All commercial facilities, including amusement parks, theatres, hotels, restaurants, and other entertainment establishments, as well as any other such public amusement venues, should have shop and establishment registration under the legislation. The term “commercial establishment” refers to:

- Any commercial sector, such as banking, commerce, or insurance.

- Hotels, restaurants, and boarding homes, as well as a smaller café or refreshment house.

- Any place where people are employed or contracted to do office work or provide services.

- Amusement and entertainment venues such as theatres and cinema halls, as well as amusement parks.

Documents necessary to apply for a Shop and Establishment Licence

The following documents are necessary for a Shop and Establishment Licence:

- Employer ID proof, such as Aadhar card/PAN card/voter identification card/driving licence.

- Photograph of the employer in passport size

- The affidavit, the cancelled cheque, and the bank statement

- A photograph of the establishment/shop, as well as the employer

- A copy of the rent agreement in the case of rented property

- Any utility bill for the working location.

Other Documents necessary depending on the Establishment or Business Entity

- A list of the number of trustees in the case of a trust

- According to the Companies Act, 2013the certificate of incorporation, MOA, and AOA are required.

- In the case of co-operative societies, a list of members and the chairperson

- Partnership Deed containing all pertinent information such as the partners’ names, signatures, and share percentages.

Procedure for Obtaining a Shop and Establishment Licence in Sikar

Physical Registration Procedure: Within 30 days of starting business, any commercial establishment/shop must apply for a licence with the chief inspector of the corresponding area. It is used in conjunction with a predefined form that demands some critical information, such as-

- The name of the employee in question,

- The establishment’s name and address,

- The number of employees in the establishment, as well as

- The planned establishment’s category and certain other details differ from state to state.

Once the application has been assessed by the inspector, the establishment is issued a licence in the next phase. The shop act licence must be displayed on the premises and must be renewed on time. Furthermore, all entities, even those working from home, must get a Shop and Establishment Licence.

Note- According to the Act, every establishment or shop that is closing down must notify the chief inspector in writing within 15 days of closing. The chief inspector also cancels the establishment’s or Shop’s registration certificate by removing it from the register.

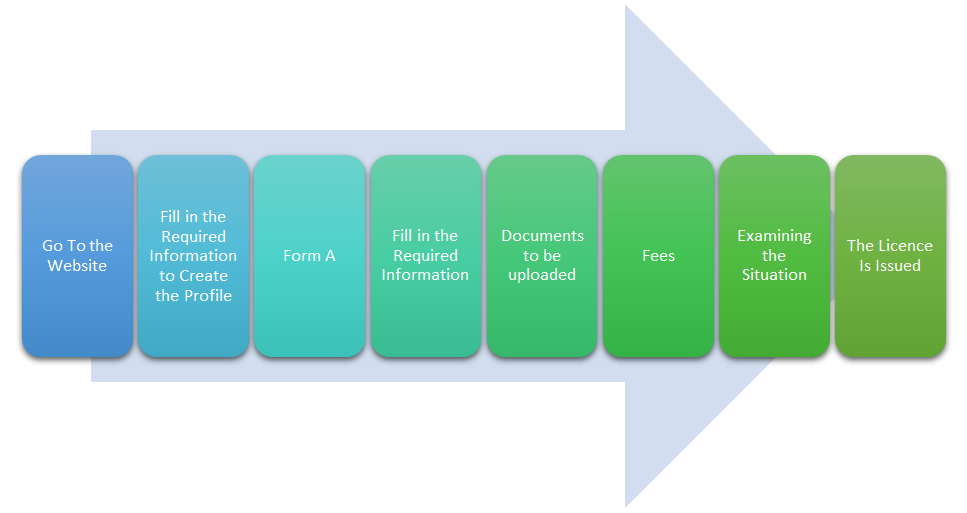

Online Procedure for Obtaining a Shop and Establishment Licence

The following is the procedure for obtaining a Shop and Establishment License:

- Go To the Website – To begin, an applicant must go to the individual state’s Labour Department website (if applicable) and create a user ID and password using the same URL.

- Fill in the Required Information to Create the Profile – The following information is required:

- The suggested establishment/shop’s name

- Employer’s name and contact information

- Employees’ names and contact information at the time

- Address of registered establishment coupled with NOC or rent agreement (only for rented buildings)

- Details of the employer’s PAN card

After the submission of these documents submission of Form A is required.

- Form A – Select Shop and Establishment Registration Form A from the drop-down menu.

- Fill in the Required Information – Choose the state and district of your store or establishment, then fill out the form with the necessary information.

- Documents to be uploaded – Once the form is completed, click the Upload documents button and attach the required documents.

- Fees – After you’ve uploaded all of your documents, go to the fees tab and pay the fees.

- Examining the Situation – An applicant can monitor the progress of their application using the under-scrutiny option.

- The Licence Is Issued – If all of the documentation is in order, the shop establishment certificate will be issued to the proposed establishment/shop.

However, in the case of physical form submission, physical verification and issue of registration certificate may take up to 15-20 working days in major city regions. It may, however, differ from one state to the next.

Exemption from the Act

Each state has its own Shops and Establishments Act, which governs the registration process as well as other rules and restrictions. The following are the exemptions allowed by the legislation in the case of the Shop Act and Establishment in Rajasthan:

- Reserve Bank of India branches.

- Offices of the Central Government, any State Government, or local government.

- Establishments for the treatment or care of the sick or mentally ill.

- Fairs or bazaars for the selling of work for charitable or other causes with no private profit.

- People whose jobs are intrinsically sporadic, such as travellers or carers.

- Libraries where the business of lending books or magazines is not conducted for monetary gain.

Penalties under Shop and Establishment Act

The entire establishment is required by the Act to obtain Shop and Establishment registration and to follow all of the Act’s rules and regulations.

However, if the business fails to register and obey the Act’s rules and regulations, it will be required to pay a penalty. The punishment amount would differ from state to state.

Compliance Requirements after getting Shop and Establishment License

Apart from obtaining the Shop and Establishment License, businesses in Sikar need to comply with certain regulations outlined in the Rajasthan Shops and Commercial Establishments Act, 1958. These include:

- Working Hours: Establishments must adhere to the prescribed working hours, including daily and weekly limits for employees.

- Employee Welfare: Businesses must provide facilities like clean drinking water, proper ventilation, lighting, and toilets for employees. Compliance with safety norms, fire prevention measures, and medical facilities is also essential.

- Leave Policies: Employers must comply with regulations regarding leave entitlements, including annual leave, sick leave, maternity leave, and other statutory provisions.

- Record Maintenance: Maintain registers and records as mandated by the Act, such as employee registers, attendance records, wage records, and employment-related documents.

How Can Legal Window Assist You in Registering Your Shop or Business?

Legal Window can help you register your business and receive a Shops and Establishments Licence in Sikar. Our team of professionals can walk you through the registration process, ensuring that you understand the stages and payments involved. We will collect all essential documents and begin the registration procedure once we have confirmed your consent. Please contact us if you have any questions – we’re here to assist you get your store or business registered.

Takeaway

Obtaining a Shop and Establishment License in Sikar is a vital step for businesses to ensure legal compliance and foster growth. By adhering to the licensing requirements and complying with relevant regulations, businesses can build trust, safeguard employee rights, access government benefits, and contribute to a healthy business environment in Sikar. Remember to stay updated with any amendments to the law and renew the license in a timely manner to avoid any disruptions to your business operations.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (123)

- Hallmark Registration (1)

- Income Tax (213)

- Latest News (34)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.