How to file ITR in Muzaffarnagar?

Have you ever wondered how to file your Income Tax Return (ITR) in Muzaffarnagar? Filing ITR in Muzaffarnagar is a straightforward process that every eligible taxpayer needs to follow. By completing this important financial task, you not only comply with the law but also unlock various benefits like claiming tax refunds, carrying forward losses, and contributing to the nation's development. Let us discuss all you need to know about filing ITR in Muzaffarnagar.

| Table of Contents |

What is ITR Filing?

ITR (Income Tax Return) filing is the process of submitting a detailed statement of an individual or entity's income to the Income Tax Department of India. It is a mandatory requirement for all eligible taxpayers to file their ITR each year, disclosing their income, deductions, and taxes paid for a specific financial year (April 1 to March 31).

The primary objective of ITR filing is to enable the government to assess the taxpayer's income and determine the amount of tax owed or any refund due. It also helps in maintaining transparency in the income declaration process and aids in the collection of taxes required for the functioning and development of the nation.

Why choose Muzaffarnagar to file ITR?

Muzaffarnagar, a city in the Indian state of Uttar Pradesh, holds significant importance for filing Income Tax Returns (ITR) due to various reasons. Here are some key factors that highlight the significance of Muzaffarnagar for ITR filing:

- Economic Activity: Muzaffarnagar is an economically active region with diverse industries, including agriculture, manufacturing, and small-scale businesses. Filing ITR in this region helps in assessing the income generated from these economic activities, contributing to the government's revenue collection.

- Regional Development: Filing ITR in Muzaffarnagar plays a vital role in regional development. Tax revenue collected from this area is utilized by the government to fund infrastructure projects, education, healthcare, and other essential services, benefitting the local community.

- Supporting Local Governance: Income tax revenue plays a crucial role in supporting local governance in Muzaffarnagar. It enables the local authorities to plan and implement various development projects and initiatives for the welfare of residents.

- Promoting Financial Inclusion: Encouraging ITR filing in Muzaffarnagar promotes financial inclusion in the region. By filing ITR, individuals and businesses become part of the formal economy, leading to improved financial transparency and accountability.

- Encouraging Tax Compliance: Filing ITR in Muzaffarnagar fosters tax compliance among residents and businesses. It encourages individuals to report their income accurately, reducing the likelihood of tax evasion and promoting fair taxation practices.

- Access to Government Benefits: Filing ITR is essential for individuals to access various government benefits, subsidies, and schemes. This includes subsidies on LPG cylinders, access to government-funded healthcare programs, and eligibility for government housing schemes.

- Ease of Financial Transactions: Having a history of ITR filing makes it easier for individuals and businesses to conduct financial transactions, apply for loans, and avail of credit facilities from banks and financial institutions.

Who Needs to File ITR?

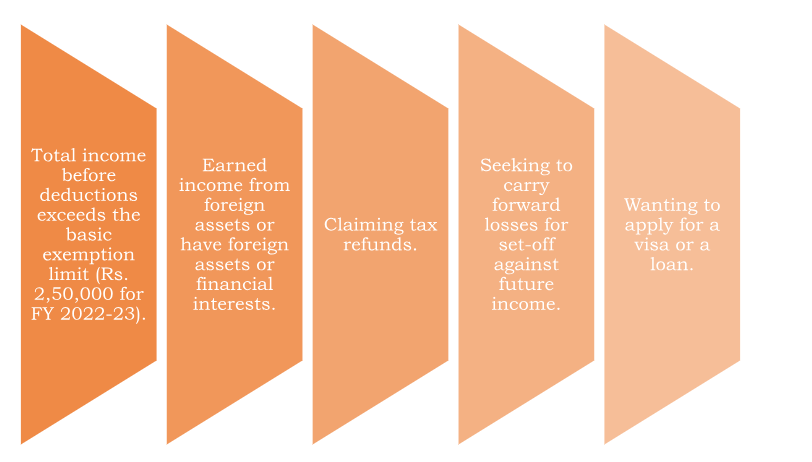

Individuals meeting any of the following criteria are required to file their income tax returns:

Types of ITR Forms in Muzaffarnagar

The type of ITR form to be filed depends on the sources and amount of income. Commonly used ITR forms are:

- ITR 1 (SAHAJ): For individuals with income from salary, one house property, other sources (excluding lottery and horse races), and agricultural income up to Rs. 5,000.

- ITR 2: For individuals and HUFs not eligible for ITR 1, having income from salary, multiple house properties, capital gains, foreign income, and agricultural income exceeding Rs. 5,000.

- ITR 3: For individuals and HUFs with income from business or profession.

- ITR 4 (SUGAM): For presumptive income from business and profession.

- ITR 5: For partnerships, LLPs, AOPs, and BOIs.

- ITR 7: For entities subject to specific tax provisions.

Important Dates for Filing ITR

For FY 2022-23 (Assessment Year 2023-24), the important dates for filing ITR are as follows:

- July 31, 2023: Due date for individuals and HUFs (non-audit cases).

- September 30, 2023: Due date for individuals and HUFs (audit cases) and companies.

Documents Required for Filing ITR in Muzaffarnagar

For income tax return filing in Muzaffarnagar, individuals and entities need to gather the following essential documents:

- PAN (Permanent Account Number) card

- Aadhaar card

- Bank statements

- Form 16 or salary certificates

- TDS certificates

- Proof of investments, deductions, and exemptions claimed

- Capital gains statements (if applicable)

- Details of other income sources.

Steps to File ITR in Muzaffarnagar

Here is a step-to-step guide for filing ITR in Muzaffarnagar-

- Gather Documents: Collect all relevant documents, such as Form 16, Form 26AS, bank statements, investment proofs, and rental income details.

- Choose the Correct ITR Form: Select the appropriate ITR form based on your income sources.

- Register on the Income Tax Portal: If not registered already, create an account on the Income Tax Department's e-filing portal.

- Fill in the Details: Enter your income, deductions, and other necessary information in the chosen ITR form.

- Verify and Submit: Review the details and submit the ITR form electronically using an Aadhaar-based OTP, EVC (Electronic Verification Code), or by sending a signed physical copy to the CPC Bangalore.

- Verify ITR Acknowledgment: After successful submission, verify the ITR acknowledgment (ITR-V) either electronically or through postal mail.

Final Words

Filing Income Tax Returns in Muzaffarnagar is a crucial financial responsibility for eligible taxpayers. Understanding the tax slabs, choosing the correct ITR form, and adhering to the filing deadlines are essential steps for a smooth tax-filing process. By following this comprehensive guide, taxpayers in Muzaffarnagar can fulfill their obligations and avoid any unnecessary penalties while staying compliant with the Income Tax Act.

In case of any query regarding filing ITR in Muzaffarnagar, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at [email protected].

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.