The Indian Income Tax Act's standard deduction is an important provision that enables taxpayers to lower their taxable income by a predetermined amount. Both salaried people and seniors receive assistance, which lowers their tax burden. This study article is an examination of the standard deduction for salaried individuals and pensioners, concentrating on the provisions of the Income Tax Act, 1961.

Contents

Standard Deduction

The standard deduction is a simple way of tax reduction accessible to salaried workers and pensioners. Individuals deduct a certain amount from their taxable income without submitting any supporting evidence.

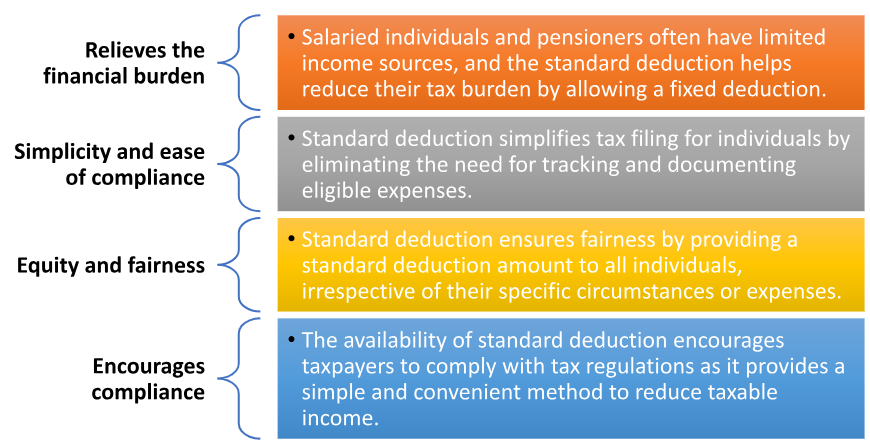

Need for Standard Deduction for Salaried Individuals and Pensioners

Standard Deduction for Salaried Individuals

- Standard Deduction in Income Tax

In the Finance Act 2023, a Benefits of Standard Deduction for Salaried Individuals and Pensioners

was introduced as a fixed deduction of INR 50,000 for salaried individuals. This amount is deducted directly from the gross salary to arrive at the total taxable income.

- Standard Deduction on Salary for AY 2023-24

A standard deduction of INR 50,000 is available to those who are salaried under Section 16(ia) of the IT Act, 1961. This is available for the fiscal year 2023–2024 to all salaried employees.

Also, read: How To Calculate Income Tax For Salaried Individuals?

Standard Deduction for Pensioners

- Standard Deduction for Senior Citizens

The senior citizens of 60 years and above are entitled to an additional standard deduction of INR 50,000. This is in addition to the INR 50,000 standard deduction given to all salaried ones.

- Standard Deduction for Pensioners for AY 2023-24

For pensioners, including senior citizens, the standard deduction of INR 50,000 is applicable for the assessment year 2023-24. This deduction can be claimed by pensioners who receive a regular pension from their former employers or the government.

Standard Deduction in the New Tax Regime

In the new tax regime introduced in the Finance Act 2020, individuals have the option to opt for a lower tax rate without claiming various specified exemptions and deductions. The standard deduction stood to people who choosing the new tax regime. Those individuals can continue to claim the fixed deduction of INR 50,000 without providing any supporting documents.

Appropriate Act and Provision

The provision for standard deduction for salaried individuals and pensioners can be found under Section 16(ia) of the Income Tax Act 1961, as amended by the Finance Act 2023. Section 16(ia) specifies the fixed deduction of INR 50,000 for salaried individuals.

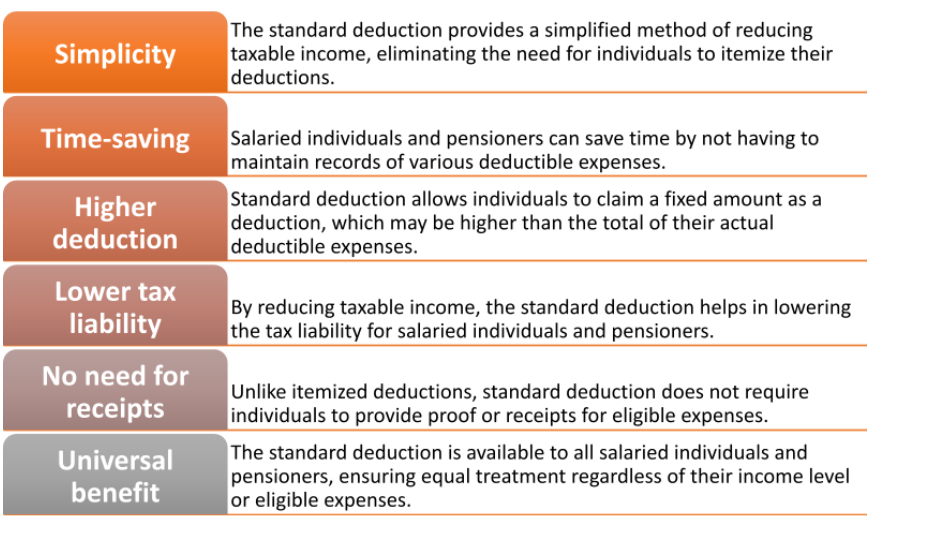

Benefits of Standard Deduction for Salaried Individuals and Pensioners

Closing Remark

The standard deduction is an essential tax relief option for paid workers and pensioners. It reduces their taxable income and tax liabilities by a predetermined amount. The provision is available for both the assessment year 2023-24 and the new tax regime. The standard deduction brings simplicity and ease of compliance to taxpayers, creating a fairer tax system.

In case of any query regarding Standard Deduction for Salaried Individuals & Pensioners, feel free to connect with our legal experts at Legal Window at 72407-51000.

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.