The Income Tax Act in India has set forth a framework for individuals to fulfill their income tax obligations by filing Income Tax Returns (ITR). While it is commonly understood that working professionals and businesses need to file ITR, there is often confusion regarding whether minors, individuals who have not yet attained the age of 18 years, are also required to file tax returns. In this article we will address the question- Does a Minor also have to File ITR?

| Table of contents |

Who is a Minor?

In India, a minor is a person below 18 years of age. According to Section 3(1) of the Indian Majority Act, 1875, every person resident in India attains majority after attaining the age of 18 years and not earlier. Minors are considered to be under the legal guardianship of their parents or appointed guardians until they reach the age of majority. This classification of minors raises questions about their tax liabilities and obligations.

Does a Minor also have to File ITR?

The confusing question arises- Does a Minor also have to file ITR? In general, minors are not subject to income tax liabilities for the income earned by them. However, some exceptions and situations may require a minor to file an income tax return.

- Clubbing of Income: The concept of "clubbing of income" applies when the income earned by a minor is included in the total income of his/her parent(s) or guardian(s) for taxation purposes. This occurs when the income generated by the minor is a result of investments made on their behalf, such as interest earned on fixed deposits, dividends, or capital gains. In such cases, the parent or guardian is responsible for including the minor's income in their tax return.

- Exceeding Tax Exemption Limits: If a minor's income, such as earnings from employment or any other source, exceeds the basic exemption limit as defined by the Income Tax Act, the minor becomes liable to file an income tax return. The current exemption limit for individuals under the age of 60 is ₹2.5 lakhs per annum. If the minor's income exceeds this threshold, they must file an ITR.

- Claiming Tax Refunds: In some instances, a minor may be eligible for tax refunds. For example, if the minor's employer has deducted tax at source on their salary, but their total income is below the taxable limit, they can claim a refund by filing an income tax return.

Taxation Rules for Minor Children: What is Compulsory to Pay?

Following are the rules taxation for Minors:

- Advances in technology have also boosted the learning skills of children. Also, the easy approach to the audience through social media has opened many opportunities for them.

- If we look around, we can see that many children are doing odd jobs and earning themselves well. But with income comes tax liability. There is no age limit for filing an income tax return.

- Minors below 18 years of age who have income in the form of earned income or unearned income or engage in certain transactions (subject to certain conditions) are liable to pay tax.

Benefits of Filing ITR as a Minor

Although minors may not always be obligated to file ITR, there are certain advantages for filling taxes as a minor doing so voluntarily:

- Establishing Financial Records: Filing income tax returns as a minor age helps minors develop a sense of financial responsibility. It allows them to start maintaining a record of their income, deductions, and investments, fostering financial discipline and awareness.

- Building a Credit History: Having a documented income tax history can be beneficial for minors in the future when they apply for loans, credit cards, or other financial services. A robust credit history helps establish their financial credibility.

- Claiming Tax Refunds: If a minor has suffered a TDS (Tax Deducted at Source) deduction on income that is below the taxable threshold, filing an ITR will enable them to claim a refund from the income tax department.

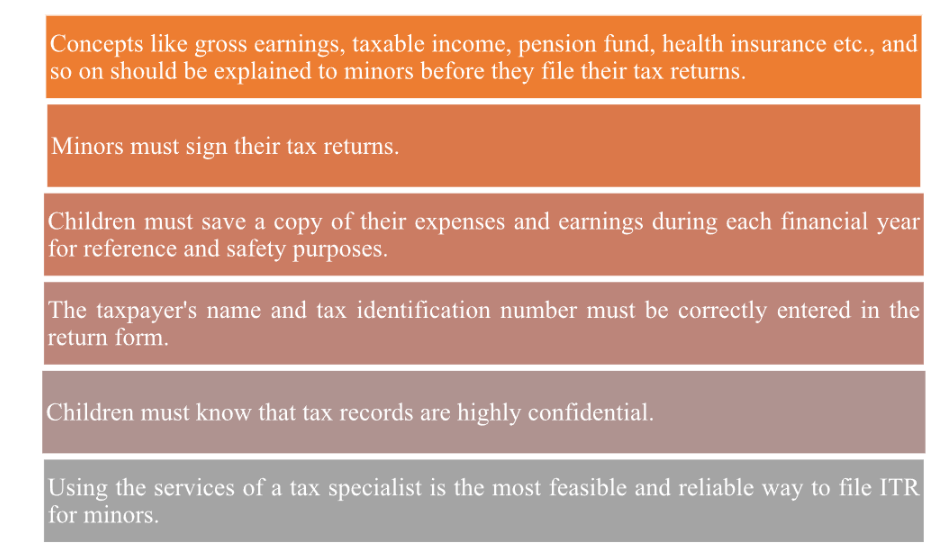

Important things to know before minor files ITR

Conclusion

In most cases, minors are not required to file income tax returns. However, if their income exceeds the basic exemption limit or falls under the clubbing provisions, it becomes necessary for Minors to file ITR. Filing income tax returns as a minor, even when not obligatory, can have long-term benefits in terms of financial awareness, establishing financial records, and claiming tax refunds. It is advisable to seek professional advice or consult a chartered accountant to determine the specific tax obligations of a minor based on their unique circumstances.

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.