Foreign Investment means investment by the Company or individual of one nation in the assets or ownership of a corporate of the another nation.

With the introduction of the LPG (Liberalization, Privatization and Globalization) Policies in the year 1992 it has became easy for the Companies of various countries to interact with each other and to branch out and invest money in the Companies of another nation.

Foreign Investment depicts the active role of the foreigner in the management of the Company as a part of their investment or holding of equity thereby influencing the business strategy.

Foreign Investments are a kind of long term investments such a establishing plants or machinery, technical know - how contracts, mergers and acquisitions etc.

Foreign Investment could be direct investment or indirect adhering to the rules and regulations as framed by the government.

The Foreign Investment sector in India is regulated by the Foreign Exchange Management Act, 1999 which is governed by the Reserve Bank of India requiring approval from the various Ministries.

OVERVIEW ON THE REGULATORY FRAMEWORK OF FOREIGN EXCHANGE MANAGEMENT ACT

REGULATION AND MANAGEMENT OF FOREIGN EXCHANGE

The chapter of II of the Foreign Exchange Management Act, 1999 governs the Capital account transactions and the Current Account Transactions through Section 5 & 6.

Section-5 (Current Account Transactions) means

- a transaction other than the Capital account transaction and includes

- Payment due in connection with the foreign trade, other current business, services and the short term banking and credit facilities in the ordinary course of business;

- Payments due as interest on loans and as net income from investments;

- Remittances for living expenses of parents, spouse and children residing abroad;

- Expenses in connection with foreign travel, education and medical care of parents, spouse and children.

The definition of current account transaction includes and any other expenditure which are not covered under the capital account transaction will be considered as current account transaction even if such transaction is not specified above.

Section-6 (Capital Account Transactions)

As per Section 2(e) of the Foreign Exchange Management Act, 1999 Capital Account transaction means such transaction which:-

- alters the assets or liabilities including contingent liabilities;

- of a person resident in India having assets or liabilities outside India;

- or a person resident outside India having assets or liabilities in India.

- It covers all the transactions as specified by under section 6(3) of the Foreign Exchange Management Act, 1999.

There are two categories for the permissible capital account transactions:-

- For person resident in India

- For person resident outside India

(Pictorial representation showing the above stated topic)

MODES OF ENTRY BY A FOREIGN ENTITY IN INDIA

Foreign Exchange Management (Establishment in India of a Branch Office or Liaison Office or a Project Office or any other place of business ) Regulation, 2016 and Companies Act, 2013

Branch Office:- Branch Office as stated in section 2(13) of Companies Act, 2013 and Schedule I of the regulations "office in relation to a company, means any establishment described as such by the company".

With the help of Branch Office foreign companies can conduct their business in India in a full-fledged manner. Branch Office are allowed to carry the same or substantially the same activities as carried out by their main/parent or group organizations.

For setting up of Branch Office in India permission from the Reserve Bank of India is required these office can primarily carry out following activities:-

- Import or Export of goods;

- Rendering of professional or consultancy services in the India;

- carrying or conducting out research work, in which the respective parent company is already engaged;

- Promoting technical or the financial collaborations between the Indian companies and parent or overseas group companies;

- Representing the parent company or overseas group companies in India and acting as the buying/selling agents in India;

- Rendering of their services in the Information Technology and the development of software in India;

- Rendering of their services for technical support to the products supplied by the parent or overseas group companies;

- Foreign airline or shipping company;

- Foreign Banks

Note: Permission from the Reserve Bank of India is required (as mentioned below) and such offices are not allowed to carry on or indulge in the manufacturing activities and business as mentioned above.

Liaison Office as defined under Schedule II also known as Representative office primarily set up for exploring the business environment and for understanding the business and investment needs and climate of a country in which the parent company wants to diversify or through which the parent company facilitates its business.

It can carry out the following activities as permitted under Annexure C of the respective regulation:-

- Representing the Parent/Group Company in India;

- Promoting Import/Export to/from India;

- Promoting technical or financial collaboration between parent/group Companies with the Companies in India;

- Acting as a communication between the parent company and the Indian Company.

Project Office is defined as a place of business which represents the interests of the foreign company which is executing a project in India but excludes a Liaison Office.

It can carry out following activities as permitted:-

- the project is directly funded through the inward remittance or;

- the project has been cleared by an appropriate authority or;

- the project is funded by a bilateral or multilateral International Financial Agency; or

- a Company or entity in India awarding the contract has granted term loan by a Public Financial Institution or a bank in India for the Project.

The difference between the Project Office and the Liaison Office is that the former can undertake commercial activities whereas Liaison Office cannot.

Note: A general permission has been granted by the Reserve Bank of India for opening Project Office in India if the above mentioned conditions are met.

Moreover, if the entity is the resident of Pakistan, Bangladesh, Sri Lanka, Iran, Afghanistan, China, Macau and Hong-Kong who wants to open Project Office in the state of Jammu Kashmir, North Eastern States and Andaman Nicobar Islands approval from Reserve Bank of India along with the consultation of Government of India is required. In all other cases, Authorized Dealer Category-I banks are empowered to grant approval.

More insight into the {Foreign Exchange Management (Establishment in India of a Branch Office or Liaison Office or a Project Office or any other place of business ) Regulation, 2016}

The permission under the Reserve Bank of India is granted by the Authorized Dealer Bank Category -I General Manager, Reserve Bank of India, Central Office Cell, Foreign Exchange Department, 6, Sansad Marg, New Delhi - 110 001.

Permission from Reserve Bank of India is required under below mentioned cases for Branch Office :-

- Applicant is a citizen of or is registered/incorporated in Pakistan;

- Applicant is a citizen of or is registered/incorporated in Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong Kong or Macau and the application is for opening a BO/LO/PO in Jammu and Kashmir, North East region and Andaman and Nicobar Islands;

- Principal business of the applicant falls in the four sectors namely Defence, Telecom, Private Security and Information and Broadcasting

certain relaxation has been provided which are as follows:-- where the government permissions or license has been granted by the Ministries;

- In case of Defence Non- residents are not required to take permission from the Reserve Bank of India if they have been awarded any contract or entered into any agreement with the Ministry of Defence or Service Headquarters or Defence Public Sector Undertakings;

- Permission does not include the general permission granted under the automatic route for FDI.

- Applicant is a Non-Government Organization (NGO), a Non-Profit Organization, or a Body/ Agency/ Department of a foreign government.

For establishing BO/LO certain Minimum Requirement shall be required to be fulfilled by a non - resident entity:-

- The entity abroad must have net worth of at least $100,000 or equivalent as per the latest audited balance sheet in case of Branch Office and at least $ 50,000 or equivalent in case of Liaison Office;

- Five Financial Year records of entity abroad of its annual profit in case of Branch Office and three year record in case of Liaison Office;

- If applicant is not financially sound or is subsidiary of a another Company can submit a Letter of Comfort as per Annexure A of Master Direction (Establishment of Branch Office (BO)/ Liaison Office (LO)/ Project Office (PO) or any other place of business in India by foreign entities) from the parent Company conditioning that the parent company satisfies the above criteria of net worth and profit.

PROCEDURE UNDER RESERVE BANK OF INDIA FOR INCORPORATION:-

- Application for Registration:-

If the above mentioned criteria is being fulfilled by the applicant then it may submit an application in FORM FNC (in accordance with the Annexure B of Foreign Exchange Management (Establishment in India of a branch office or a liaison office or a project office or any other place of business) Regulations, 2016) to an Authorized Dealer Category-I bank with the following documents.- A Copy of the Certificate of Incorporation or Registration along with the charter documents such as Memorandum of Association and Articles of Association to be attested by the Notary Public in the country of registration or incorporation.

The above documents must be translated in English (if in any other language) and the same has been notarized as above also cross verified/attested by the Indian Embassy/ Consulate in the home country] - A Copy of the Audited Balance sheet of an applicant company for the last three in case of branch office and five years liaison office.

[In case the applicants’ home country laws/regulations does not insist on the auditing of accounts, an Account Statement to be certified by a Certified Public Accountant (CPA) or any other Registered Accounts Practitioner by any name, clearly showing the net worth may be submitted] - Bankers’ Report from the applicant’s banker in the host country / country of registration showing the number of years the applicant has had banking relations with that bank.

A Power of Attorney must be executed in favor of the person signing the FORM FNC if the Head of the overseas entity is not signing the same.

- A Copy of the Certificate of Incorporation or Registration along with the charter documents such as Memorandum of Association and Articles of Association to be attested by the Notary Public in the country of registration or incorporation.

- Due-Diligence by the AD Bank Category I :-

AD bank Category-I shall exercise due diligence in respect of the applicant’s background & satisfy itself with respect to adherence to the eligibility criteria for establishing BO/LO, antecedents of the promoter, nature & location of activity, sources of funds, etc., of the applicant and compliance with the norms of KYC may grant approval to the foreign entity for establishing BO/LO in India.

- Allotment of Unique Identification Number:-

AD Category-I banks may also frame an appropriate policy for dealing with these applications in conformity with the FEMA Regulations and Directions.

Subsequently before issuing the approval letter, it shall forward the copy of Form along with the details to the General Manager of the Reserve Bank of India CO Cell, New Delhi, for allotment of Unique Identification Number (UIN) to each BO/LO.

Issue of Approval Letter:-

Once the Reserve Bank of India issues the UIN the AD Category Bank shall issue a approval letter to the applicant entity

SOME IMPORTANT POINTS

- The applicant entity may after approval may establish, the approval of RBI shall elapse after 6 months, extension shall be subject to approval of Reserve Bank of India.

- An applicant can shift its office to any place in India subject to approval of the AD bank category I except if the office is shifted within the same city no prior approval is needed.

- If the BO/LO wants to change the name it can be done with the permission of AD Bank except if there is no change in the ownership of foreign company. Further if there is a change due to merger acquisition or change in ownership of the parent company then the closure of BO/LO is required and a fresh approval is required.

PROVISIONS WITH RESPECT TO COMPANIES ACT, 2013

Any foreign entity which has established its place of business in India either by way of Branch office, liaison office or any other place of business shall be treated as same as foreign company as defined under section 2(42) of the Companies Act, 2013 which says that

"A foreign company is a company or body corporate incorporated outside India having a place of business in India whether by itself or through an agent, physically or through electronic mode and conducts any business activity in India in any other manner."

Procedure for incorporating a BO/PO under Companies Act, 2013.

- Obtaining DIN:-

The first step is to obtain DIN (Director Identification Number) by filling a form (DIR-3 )and submitting the signed copy of the same along with the proof of identity and address for further process which will be granted after verification and approval.

- Obtaining Digital Signature Certificate:-

The next step is to obtain the DSC the Company director's are required to fill the prescribed application form along with proof of identity and address.

- Submitting e-form FC-1:-

At the third step and in accordance with the Rule 3(3) of the Companies (Registration of Foreign Companies) Rules, 2014 an e-form FC-1 is to be filled by every foreign company within 30 days from establishment of place of business in India with the following documents:- Translated and Notarized or apostle copy of the certificate of incorporation/ registration of foreign entity.

- Translated and Notarized copy Charter, statutes or memorandum and articles of association or other Instrument constituting or defining the constitution of the foreign entity.

- The List of directors and secretary of the foreign entity

- Power of Attorney /Board Resolution in favor of authorized representative

- Approval letter from Reserve Bank of India.

- Filing of the said e-form on the portal of Ministry of Corporate Affairs:-

The same form is to be filed with the respective Registrar of the Companies on the portal of Ministry of Corporate Affairs.

- Getting the Incorporation Certificate:-

Once, the ROC is satisfied with the documents provided it will incorporate the Company by providing a Certificate stating the date of incorporation, Corporate Identification Number etc. By granting this Certificate a Company is born in the eyes of law.

Post Incorporation requirements

- After incorporation of BO/PO/LO of a Foreign Company it is required to obtain PAN (Permanent Account Number) which can be done using the NSDL site if the Aadhar Card is linked with the mobile number or a physical form can be filed using the form 49A , after verification of the documents the income tax department issues PAN Card.

- The BO/PO/LO of a Foreign Company is also required to obtain TAN (Tax Deduction and Collection Account Number) which can be obtained by filing form 49 B and can be submitted at any TIN Facilitation Centre. After verifying the application by the Income Tax Department , TAN is issued. The application can be made both ways i.e. online and offline.

FOREIGN DIRECT INVESTMENT

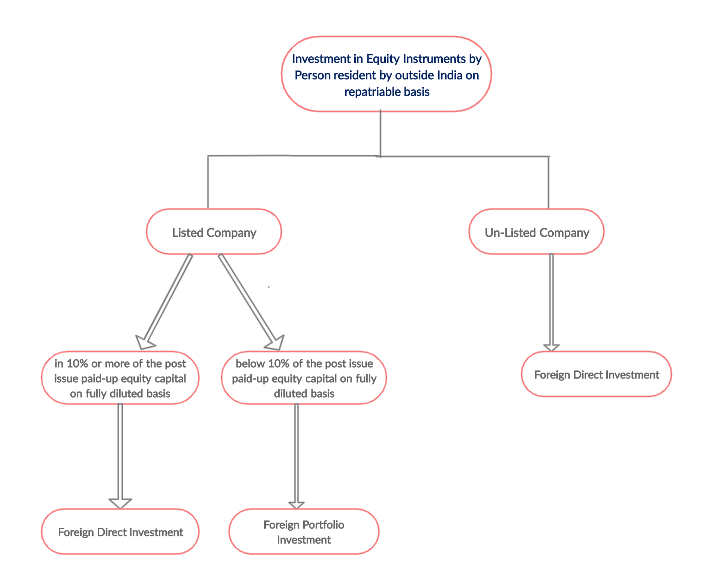

Foreign Direct Investment means investment made by the person resident outside India either in unlisted Indian Company or a listed Indian Company (in 10% or more of the post issue paid-up equity capital on a fully diluted basis (if all possible sources of conversion are exercised). A Person resident outside India is eligible to invest in the Debt and Non Debt Instruments as notified by the Ministry of Finance which covers following regulations.

| Non-Debt Instruments | Debt Insturments |

| 1. FEM (Non – Debt Instruments) Rules, 2019 · was notified on October 17,2019; · superseded the earlier FEM (Transfer of Issue of security by a person resident outside India) TISPRO Regulations, 2017; · supersedes the earlier FEM (Acquisition and Transfer of Immovable Property in India) Regulations, 2018 2. FEM (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 · was notified on October 17, 2019; · Sectors specified v/s Sectors not specified; · Automatic v/s approval route; · Foreign Direct Investment v/s Foreign Portfolio Investment · Direct investment v/s indirect foreign investment; · Repatriable v/s non-repatriable | 1. FEM (Debt Instruments) Regulations, 2019 |

Now let us through some light on the classification of Debt Instruments and Non-debt instruments:-

Debt Instruments includes Government Bonds, Corporate Bonds, All tranches of securitization structure which are not equity tranche, Borrowing by Indian Firms through Loans, Depository receipts whose underlying securities are debt securities.

Non-Debt Instruments includes all investments in equity incorporated entities such as private, public (listed or unlisted), Capital investment in the Limited Liability Partnership, All such instruments as recognized in the FDI Policy, Investment in the Alternative Investment Funds or the Real Estate Investment Trust or Infrastructure Investment Trust, Investment in the units of the Mutual Funds or Exchange Traded Fund who invest more than 50% in equity, the junior equity tranche of the securitization structure, acquisition, sale or dealing directly into the immovable property, contribution to trust, Depository receipts issued against the Equity instruments.

SOME OF THE DEFINITIONS WHICH REQUIRES ATTENTION

Section 2 (c) defines “authorized person” as “an authorized dealer , money changer, offshore banking unit or any other person for the time being authorized under sub-section (1) of section 10 to deal in foreign exchange or foreign securities”

Section 2 (n) defines “foreign exchange” as

“foreign exchange means foreign currency and includes,-

- deposits, credits and balances payable in any foreign currency,

- drafts, travelers cheques, letters of credit or bills of exchange, expressed or drawn in Indian currency but payable in any foreign currency,

- drafts, travelers cheques, letters of credit or bills of exchange, drawn by banks, institutions or persons outside India, but payable in any foreign currency;”

Section 2 (v) defines “person resident in India” as"

- a person residing in India for more than one hundred and eighty two days during the course of the preceding financial year but doesnot include –

- a person who has gone out of India or who stays outside India, in either case –

- for or on taking up employment outside India, or

- for carrying on outside India a business or vocation outside India, or

- for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period

- any person or body corporate registered or incorporated in India;

- an office, branch or agency in India owned or controlled by a PROI,

- an office, branch or agency outside India owned or controlled by a person resident in India".

Section 2 (y) defines “repatriate to India” as“bringing to India the realized foreign exchange and-

- The selling of such foreign exchange to an authorised person in India in exchange for rupees, or

- The holding of realized amount in an account with an authorised person in India to the extent notified by the Reserve Bank, and includes use of the realized amount for discharge of a debt or liability denominated in foreign exchange and the expression repatriation shall be construed accordingly;”

"Investment on repatriation basis" means an investment, the sale/ maturity proceeds of which are, net of taxes, eligible to be repatriated out of India, and the expression ‘Investment on non repatriation basis’, shall be construed accordingly.

"Foreign Portfolio Investment" means an investment made by the person resident outside India in any capital instruments where such investment is

- less than 10 % of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company or

- less than 10 % of the paid up value of each series of capital instruments of a listed Indian company.

As per Para 4 of RBI Master Direction on Foreign Investment In India the Capital Instruments are as follows:-

SUMMARY OF FDI Vs FPI

DOWNSTREAM INVESTMENT/ INDIRECT INVESTMENT

Indirect Foreign Investment or Downstream Investment means an investment made by another Indian Entity in the Capital Instruments by an Indian Entity who has received an amount of foreign investment and;

- is not owned and not controlled by resident Indian citizens; or

- is owned or controlled by persons resident outside India.

Investment made by an investment vehicle whose sponsor or manager or investment manager;

- is not owned and not controlled by resident Indian citizens; or

- is owned or controlled by persons resident outside India.

Note: Ownership of an Indian company shall mean beneficial holding of more than 50 percent of the capital instruments of such company.

For understanding more lets us look at some examples:-

- ABC Inc. (a person resident outside India) is holding 80% equity shares of PQR Limited (a person resident in India) and thereby a subsidiary of ABC Inc., Further the PQR Limited has invested 60% in XYZ Private Limited, what will be the extent of indirect foreign investment in XYZ Private Limited?

- 80%

- 60%

- 52%

- None of the above

The answer will be 60%

- Continuing the above stated example, what will be the extent of indirect foreign investment in XYZ Private Limited if PQR Limited holds 100% of its share capital?

- 80%

- 20%

- 100%

- None of the above

The answer will be 80%

ENTRY ROUTES

There are two ways to enter which are as follows:-

- Automatic or Approval Route:- In this no prior approval from government is required by the foreign investor or the Indian Company. It allows all FDI in all sectors and activities specified under the FDI Policy.

- Government Route or the Approval Route is the entry route through which the investment made by a person resident outside India requires a prior Government approval. The Foreign investment received under the approval route shall be according to the conditions stipulated by the Government in its approval.

Government approval' is approval from the erstwhile Secretariat for Industrial Assistance (SIA), Department of Industrial Policy and Promotion, Government of India and/ or the erstwhile Foreign Investment Promotion Board (FIPB) and/ or any of the ministry/ department of the Government of India, as the case may be.

SECTORS IN WHICH FDI IS NOT ALLOWED

- Atomic Energy Generation

- Cigars, Cigarettes, or any related tobacco industry

- Lotteries (online, private, government, etc)

- Investment in Chit Funds

- Agricultural or Plantation Activities (although there are many exceptions like horticulture, fisheries, tea plantations, Pisciculture, animal husbandry, etc)

- Housing and Real Estate (except townships, commercial projects, etc)

- Trading in TDR’s (Trade Development Rights)

- Any Gambling or Betting businesses

REPORTING REQUIREMENTS AND PRICING GUIDELINES

As per Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) (Amendment) Regulations, 2019

Form FC-GPR

Issuing capital instruments to a person resident outside India shall be reported in form FC-GPR within 30 days from the date of allotment of capital instruments;

Pricing Guidelines:-

Swap of equity instruments

- valuation by SEBI registered Merchant Banker; or

- Investment Banker outside India

Shares by way of subscription to MOA

- at face value

- subject to entry route & sectoral caps.

Share warrants

- pricing and price/conversion formula shall be determined upfront.

Pricing guidelines are not applicable for the investment in equity instruments by Person Resident Outside India on non-repatriation basis.

Listed company

- as per SEBI Guidelines

Unlisted company

- as per valuation

- done as per any internationally accepted pricing methodology for valuation on an arm’s length basis;

- duly certified by Chartered Accountant;

- SEBI registered Merchant Banker

- Practicing Cost Accountant

Company going through delisting process

- as per SEBI (Delisting of Equity Shares) Regulations, 2009.

Form FC-TRS

Person Resident Outside India who is holding capital instruments in an Indian company on a repatriable basis and a Person Resident Outside India holding capital instruments on a non-repatriable basis; and Person Resident Outside India holding capital instruments in an Indian company on a repatriable basis and a Person Resident in India shall within 60 days from the transfer of capital instruments or receipt/ remittance of funds whichever is earlier. shall report to Reserve Bank of India in Form FC-GPR.

Form-DI

An Indian entity or an investment Vehicle making downstream investment in another Indian entity which is considered as indirect foreign investment for the investee Indian entity within 30 days from the date of allotment of capital instrument shall report in Form DI.

Form-ESOP

An Indian company issuing employees’ stock option to persons resident outside India within 30 days from the date of issue of employees’ stock option.

Form DRR (Depository Receipt Return)

Reporting of issue/ transfer of depository receipts (ADR/ GDR) issued in accordance with the Depository Receipt Scheme, 2014 by the Domestic Custodian within 30 days of close of the issue.

Form LLP (I)

LLP receiving amount of consideration for capital contribution and acquisition of profit shares within 30 days from the date of receipt of the amount of consideration.

Form LLP (II)

Disinvestment/ transfer of capital contribution or profit share between a resident and a non-resident (or vice versa) within 60 days from the date of receipt of funds

Form Convertible Notes (CN)

Issue of Convertible Notes to a Person Resident Outside India by an Indian startup company; or Transfer of Convertible Notes to or from Person Resident Outside India within 30 days of such issue/ transfer

Annual Return on Foreign Liabilities and Assets (FLA)

Every Indian Company/ Limited Liability Partnership which has received FDI/Capital contribution in the previous year's including the current year shall file FLA on or before July 15 of every year with Reserve Bank of India.

DELAY IN REPORTING

- The Late Submission Fees shall be applicable for the transactions undertaken on or after November 7, 2017.

- The payment of LSF is an option for regularizing reporting delays without undergoing the compounding procedure.

- For calculating the LSF amount, the period of contravention shall be considered proportionately {(approx. rounded off to next higher month ÷ 12) X amount for 1 year}.

- The date of reporting to the AD bank shall be deemed to be the date of reporting to the Reserve Bank provided the prescribed documentation is complete in all respects.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.