Taxation on Political Parties -Representation of People Act, 1951

- March 9, 2022

- Income Tax, Miscellaneous

The Representation of the People Act, 1951 governs political groups in India (RPA). A certain organization of Citizens as well as group of particular Indians claiming to be a political entity must apply towards the Election Commission to be recognized as a political group as per Section 29A of a RPA in opportunity to involve in elections as well as to benefit from some of the other aspects of the RPA.RPA further enables politicians to accept charitable donations from anybody else, especially corporations , while prohibiting funding from international entities just like people of abroad, foreign enterprises, international corporations, and global trustees. All political parties are registered under the Representation of Peoples Act, 1951. Section13A and section 29A of the said act deals with it.

Let us cover the Taxation of Political Parties in this blog.

| Table of Contents |

Is their taxation of political parties?

Major parties are out law from engaging in any commercial transactions in attempt to benefit. But that’s not to say that the political group is bankrupt. They are allowed to solicit voluntary donations under RPA, as previously stated. Furthermore, major parties might own the possessions or bank accounts that generate revenue. Major parties might profit from either the sale of coupons, membership fees, and other sources. Political groups, on the other hand, are exempt from paying taxes on their revenue from residential properties, revenue from several other sources, corporate taxes, and charitable donations accepted from every individual under Section 13A, subject to certain circumstances.

Scope of section 13A

- They must get themselves register under the Section 29A of the Representation of Peoples Act, 1951.

- A person authorized to prepare an account for contributions in excess of Rs on behalf of or in the finance of a political party. Under the 29C RPA, pay 20,000 to the Indian Election Commission for a fiscal year no later than the filing date for income tax for the same fiscal year.

- Although Article 13A is followed for the regulation on the absence of tax benefits for non-reporting, it is possible to refer to Article 29C of the RPA itself, which cancels tax benefits for political parties if they do not file a report.

- Keeping books and other documents to allow assessors to earn income – note that political parties do not have to keep all books, as described in Section 44AA. Political parties need only keep such books for AOs to generate income.

- Keep a record of all donations of Rs 20,000 or more, including the name and address of the person making the donation, unless the donation is made in the form of an election endorsement.

- To have a certified public accountant audit the books of accounts

- Never received a donation of more than Rs 2,000 by any means other than a beneficiary’s check/draft or ECS, or a bank account or election bond.

How political parties can file Income Tax Return?

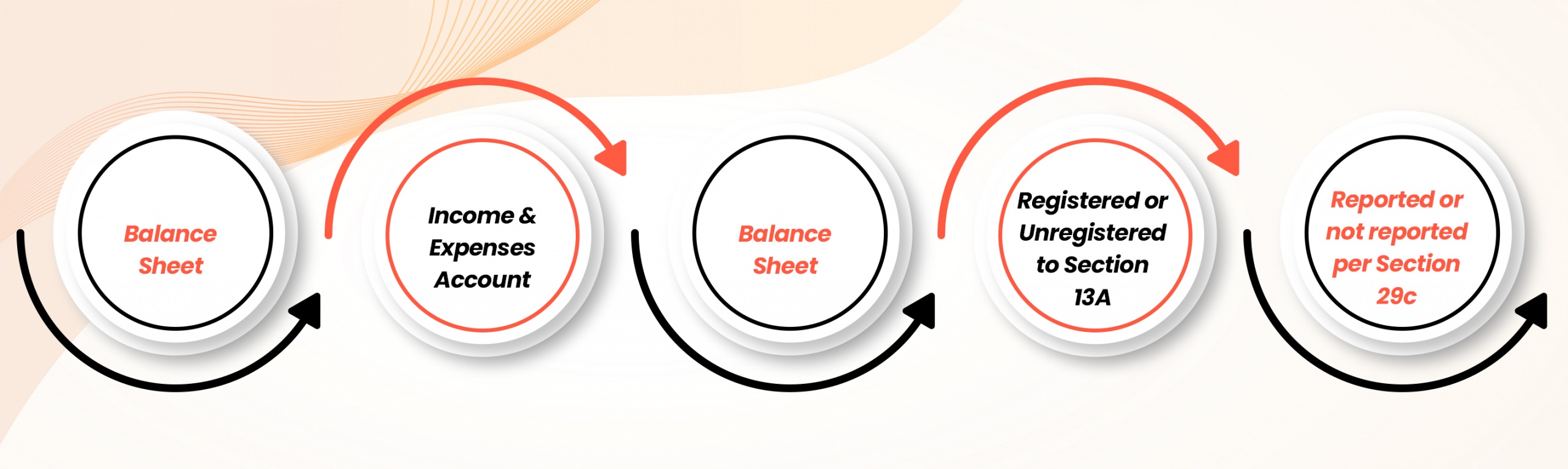

It is requisite to file an annual tax return each fiscal year by filing an ITR 7 form. Here is the information you need to fill out in ITR 7.

- Balance Sheet: Information on Sources of Funds – General Funds, Loans, etc. and Subsequent Use or Expenditure in the Form of Investments, Assets, and Advances. Etc.

- Income and Expenses Account: Income and subsequent expenses from the sale of voluntary contributions, contributions, fees, grants, coupons, etc.

- Donation Statement: 20,000 donations of KRW 1 million or more, including donor name

- Registered or unregistered pursuant to Section 13A RPA, 1951.

- Reported or Not Reported per Section 29C RPA, 1951 with the date the report was lodge.

Section 80GGC

It provides tax credits for funds to the parties. This can vary between 50% and 100% of the deposit amount. This promotes a strong political system and results in significant tax savings. Section 80 of Income Tax Act for the credit status of GGC applies to donations made by individuals to political parties. Under Section 80GGC, individuals are authorizing to a tax credit of 50% to 100% of the donation amount. Income tax Law allows individuals to donate up to 10% of their total income to selected political bodies. Individuals who take advantage of the Section 80 GGC deduction can save significant amounts of tax each fiscal year, along with housing allowances, medical care etc.

Under Section 80GGC, ITR filling for individuals may only donate or make donations to the following organizations:

- Electoral trust

- Registered political party

Conclusion

Political parties do have an income so as far as Income Tax Return is concerned. So, they are also mandate to pay the same. However, according to my perspective this is must to keep transparency and to minimize corruption. Since, this will help in keeping the essence of democracy alive. Lastly taxation on political parties is must.

Further, for more detail info contact our experts.

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (123)

- Hallmark Registration (1)

- Income Tax (213)

- Latest News (34)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.