GST Portal Login Guide: A Guide to Take You Through the GST Registration Process

- October 17, 2023

- GST

The GST is an indirect tax introduced in India on 1st July 2017. It is a comprehensive, destination-based tax that has replaced multiple indirect taxes levied by the central and state governments. This article aims to provide a detailed guide on the GST registration process through the GST portal login.

Contents

Understanding the GST Registration Process

Before diving into the GST portal login guide, it is important to understand the GST registration process. GST registration is mandatory for businesses with an annual turnover exceeding the threshold limit of 40 lakhs INR (20 lakhs for special category states). Additionally, certain businesses like e-commerce operators and suppliers, non-resident taxable persons, and input service distributors are also required to register under GST, irrespective of their turnover.

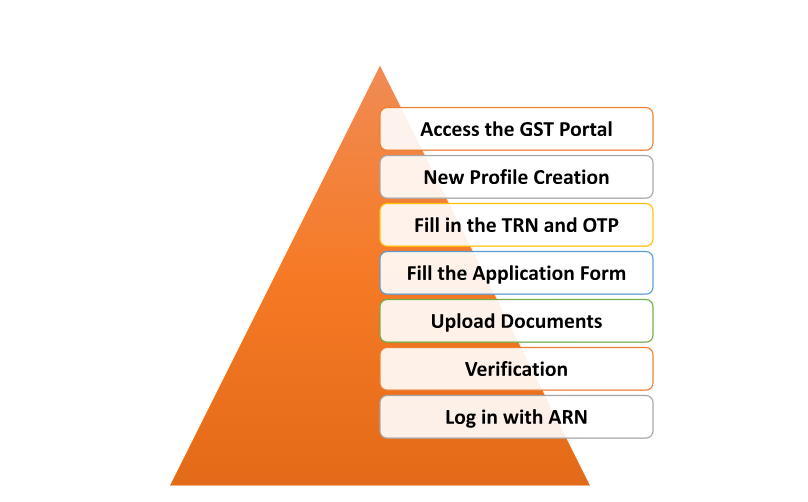

Step-by-Step Guide to GST Registration through the Portal

The GST registration process can be completed online through the GST portal login. Follow the step-by-step guide provided below for a seamless GST registration process:

- Step 1: Access the GST Portal

Get into the “www.gst.gov.in“, dashboard to enter into the GST portal through your web browser. You will find the GST “Login ID“ button there and you need to click here for further proceedings.

- Step 2: New Profile Creation

For the creation of a new profile, you have to click on the “Register Now” button. After, you should add the basic information about you to get your TRN.

- Step 3: Fill in the TRN and OTP

You have to go back to the login page once you receive the TRN (Temporary Reference Number). Then you have to enter the TRN in the provided column. You will also receive an OTP on the registered mobile number and email address. Enter the OTP to verify your details.

- Step 4: Fill the Application Form

After successful verification, you will be redirected to the GST registration page. This page contains different sections like business details, promoter or partner details, authorized signatory details, etc. Add all the information needed and click the button “Save & Continue”.

- Step 5: Upload Documents

In this step, you will be required to upload several documents related to your business, such as proof of business registration, address proof, bank account details, authorized signatory details, etc. You have to ensure that these documents are ready in digital format for easy uploading.

- Step 6: Verification

After uploading the required documents, a verification process will be initiated. This may include physical verification of the premises and documents by the GST authorities. Once the verification is complete, you will receive a notification regarding the successful registration of your business under GST.

- Step 7: Log in with ARN

Once the registration is approved, you can log in to the GST portal using your credentials. Enter the ARN (Application Reference Number) provided at the time of registration to access your dashboard. The dashboard will provide all the necessary tools and features for GST compliance, such as filing GST returns, claiming input tax credits, viewing/updating profiles, etc.

End Note

The GST portal login is an essential tool for businesses to register and comply with the Goods and Services Tax. Through this comprehensive guide, businesses can successfully navigate the registration process on the GST portal. It is crucial to provide accurate information and complete all the required steps to ensure a smooth GST registration process. Once registered, businesses can leverage the benefits of GST and contribute to the nation’s growth and development.

In case of any query regarding the GST Portal Login and GST Registration Process, feel free to connect with our legal experts at Legal Window at 72407-51000.

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (123)

- Hallmark Registration (1)

- Income Tax (213)

- Latest News (34)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.